Europe Aseptic Sampling Market Introduction and Overview

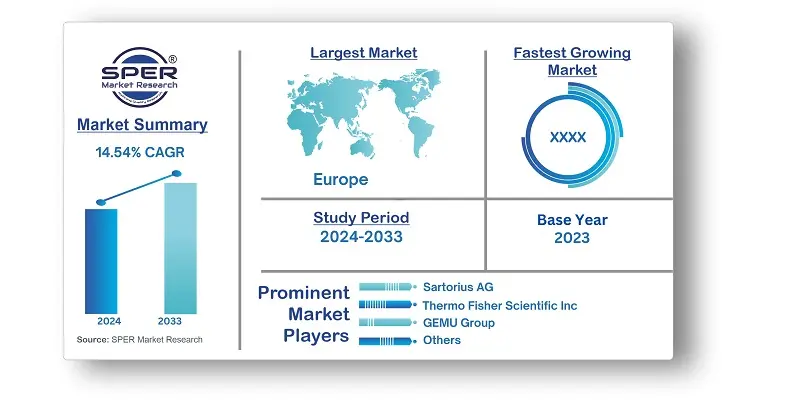

According to SPER Market Research, the Europe Aseptic Sampling Market is estimated to reach USD 579.9 million by 2033 with a CAGR 14.54%.

The report includes an in-depth analysis of the Europe Aseptic Sampling Market, including market size and trends, product mix, distribution channels, and supplier analysis. Aseptic sampling is essential to preserving product safety and quality, particularly in the biotechnology and pharmaceutical sectors where sterility and purity of the product are crucial. The procedure makes use of a variety of tools and supplies, including sterile collection bags, vials, samplers, scoops, and other supplies, to gather samples.

- Merck kGaA and Agilent technology established a partnership in June 2022 to close the process analytical technology gap in the downstream processing industry. The partnership will contribute to a further rise in income.

- The Europe Bioprocessing Excellence Awards 2021 "Overall Best Bioprocessing Supplier" winner was revealed by Sartorius AG, a prominent global partner of life science research and the biopharmaceutical industry, in November 2021. The company has benefited from receiving recognized for their efforts thanks to this award.

Market Opportunities and Challenges

Opportunities: Increase in Technological Progress One of the key elements driving the growth of the aseptic sample market in Europe is the development of new technologies in this field. Thanks to the advancement of sophisticated sample tools and methods, businesses may now increase the precision, effectiveness, and dependability of their operations. Businesses are investing heavily in R&D to stay at the top of the market as a result of these advancements, which are opening up new growth potential for the industry.

One of the most important technological developments in the aseptic sampling industry is the creation of automated systems. These devices increase the speed and precision of the sampling procedures by utilizing robotics and artificial intelligence.

Challenges: Aseptic sampling involves collecting samples in a sterile environment to prevent contamination in a variety of industries, such as biotechnology, pharmaceuticals, food, and beverages. However, aseptic sampling techniques are not universally applied across industries and applications, which could lead to variable outcomes and limit the comparability of data. Aseptic sampling is not standardized when regulatory organizations lack explicit rules and norms. While regulatory authorities provide broad guidelines for aseptic sampling, there is no standardization for aseptic sampling methods, sample quantities, instruments, or validation strategies. This could make it difficult to achieve consistent results across different industries and applications and lead to confusion in the corporate world

Market Competitive Landscape

The Aseptic Sampling market in Europe moderately consolidated. Some of the market key players are Sartorius AG, Thermo Fisher Scientific Inc., GEMU Group, Merck KGaA, SAINT-GOBAIN, GEA Group Aktiengesellschaft, Avantor, Inc., ALFA LAVAL, W. L. Gore & Associates, Inc., Shanghai LePure Biotech Co., Ltd., and Others.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | By Type of Sampling, By Application, By End User

|

| Regions covered | UK, France, Germany, Italy, Spain, Rest of Europe

|

| Companies Covered | Sartorius AG, Thermo Fisher Scientific Inc., GEMU Group, Merck KGaA, SAINT-GOBAIN, GEA Group Aktiengesellschaft, Avantor, Inc., ALFA LAVAL, W. L. Gore & Associates, Inc., Shanghai LePure Biotech Co., Ltd., and Others.

|

COVID-19 Impact on Europe Aseptic Sampling Market

The Europe Aseptic Sampling Market has been severely damaged by the COVID-19 outbreak. The market has trouble sustaining operational continuity due to strict lockdown measures and supply chain interruptions. The need for aseptic sample items was unparalleled in the healthcare industry, especially in the pharmaceutical and biotechnology sectors given the urgency of developing vaccinations and therapies for the virus. However, market expansion was hampered by delays in clinical trials and regulatory permissions, as well as lower production capabilities brought on by a lack of labor and logistical issues.

Key Target Audience:

- Biopharmaceutical Companies

- Pharmaceutical Manufacturers

- Contract Manufacturing Organizations (CMOs)

- Research Laboratories

- Academic Institutions

- Regulatory Bodies

Our in-depth analysis of the Europe Aseptic Sampling Market includes the following segments:

|

By Type of Sampling: |

Manual Aseptic Sampling

Bags

Bottles

Others

Automated Aseptic Sampling

|

|

By Application: |

Upstream Process

Downstream Process

|

|

By End User: |

Biotechnology and Pharmaceutical Manufacturers

Contract Research and Manufacturing Organizations

Others

|

Key Topics Covered in the Report:

- Europe Aseptic Sampling Market Size (FY’2024-FY’2033)

- Overview of Europe Aseptic Sampling Market

- Segmentation of Europe Aseptic Sampling Market By Type of Sampling (Manual Aseptic Sampling, Automated Aseptic Sampling)

- Segmentation of Europe Aseptic Sampling Market By Application (Upstream Process, Downstream Process)

- Segmentation of Europe Aseptic Sampling Market By End User (Biotechnology and Pharmaceutical Manufacturers, Contract Research and Manufacturing Organizations, Others)

- Expansion Analysis of Europe Aseptic Sampling Market

- Problems and Obstacles in Europe Aseptic Sampling Market

- Competitive Landscape in the Europe Aseptic Sampling Market

- Impact of COVID-19 and Demonetization on Europe Aseptic Sampling Market

- Details on Current Investment in Europe Aseptic Sampling Market

- Competitive Analysis of Europe Aseptic Sampling Market

- Prominent Players in the Europe Aseptic Sampling Market

- SWOT Analysis of Europe Aseptic Sampling Market

- Europe Aseptic Sampling Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

4.2. COVID-19 Impacts of the Europe Aseptic Sampling Market

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Europe Aseptic Sampling Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Europe Aseptic Sampling Market

7. Europe Aseptic Sampling Market, By Type of Sampling (USD Million) 2020-2033

7.1. Europe Aseptic Sampling Market Size, Share and Forecast, By Type of Sampling, 2020-2026

7.2. Europe Aseptic Sampling Market Size, Share and Forecast, By Type of Sampling, 2027-2033

7.3. Manual Aseptic Sampling

7.3.1. Bags

7.3.2. Bottles

7.3.3. Others

7.4. Automated Aseptic Sampling

8. Europe Aseptic Sampling Market, By Application (USD Million) 2020-2033

8.1. Europe Aseptic Sampling Market Size, Share and Forecast, By Application, 2020-2026

8.2. Europe Aseptic Sampling Market Size, Share and Forecast, By Application, 2027-2033

8.3. Upstream Process

8.4. Downstream Process

9. Europe Aseptic Sampling Market, By End User (USD Million) 2020-2033

9.1. Europe Aseptic Sampling Market Size, Share and Forecast, By End User, 2020-2026

9.2. Europe Aseptic Sampling Market Size, Share and Forecast, By End User, 2027-2033

9.3. Biotechnology and Pharmaceutical Manufacturers

9.4. Contract Research and Manufacturing Organizations

9.5. Others

10. Europe Aseptic Sampling Market Forecast, 2020-2033 (USD Million)

10.1. Europe Aseptic Sampling Market Size and Market Share

11. Europe Aseptic Sampling Market, By Region, 2020-2033 (USD Million)

11.1. Europe Aseptic Sampling Market Size and Market Share By Region (2020-2026)

11.2. Europe Aseptic Sampling Market Size and Market Share By Region (2027-2033)

11.3. Eastern

11.4. Western

11.5. Northern

11.6. Southern

12. Company Profile

12.1. Sartorius AG

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Thermo Fisher Scientific Inc.

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. GEMU Group

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Merck KGaA

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. SAINT-GOBAIN

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. GEA Group Aktiengesellschaft

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Avantor, Inc.

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. ALFA LAVAL

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. W. L. Gore & Associates, Inc.

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Shanghai LePure Biotech Co., Ltd.

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links