North America Freight and Logistics Market Introduction and Overview

According to SPER Market Research, the North America Freight and Logistics Market is estimated to reach USD XX billion by 2033 with a CAGR of 4.79%.

The report includes an in-depth analysis of the North America Freight and Logistics Market, including market size and trends, product mix, distribution channels, and supplier analysis. The processes of moving goods and commodities by rail, trucks, road vehicles, and big boats carrying containers and aircraft are known as freight and logistics. It provides contract logistics, warehousing, value-added services, and sophisticated integrated logistics solutions that are planned and delivered for complex worldwide supply chains. The expansion of the freight and logistics market is being driven by the growth of trade-related agreements, global logistics infrastructure, and technological advancements in the logistics industry for quick delivery and supply chain management.

- November 2022: The German Bobsleigh, Luge, and Skeleton Federation (BSD) and DHL extended their collaboration for an additional four years. The premium and logistics agreement dates back to the winter season of 2014–2015. It covers athlete apparel and sports equipment branding in addition to logistics for all equipment used during the seasons.

- In October 2022: a less-than-truckload service center was established in Chicago by XPO Logistics. In order to handle large quantities, the 150,000 square foot service facility has 264 dock entrances.

Market Opportunities and Challenges

Opportunities: Several factors are now driving the logistics market in North America. The growing demand for imported goods from North American countries, particularly in emerging economies like Indonesia, Thailand, and India, is driving the growth of the logistics sector in the North American region. The demand for commodities in the North American region increased sharply as a result of rising trade volumes among the participating nations.

In addition, the growing e-commerce industry, the development of reverse logistics, and the rise in trade agreements are all factors propelling market expansion. The expansion is also anticipated to be fueled by the emergence of tech-driven logistics services and the expanding use of connected IoT devices.

Challenges: The freight and logistics sector in North America is confronted with a variety of noteworthy challenges, which arise from a confluence of elements including restricted infrastructure, intricate regulations, and changing customer demands. The burden on infrastructure, such as ports, railroads, and highways, which are frequently crowded and antiquated and cause inefficiencies and delays in the flow of commodities, is one of the main problems. Regulatory compliance requirements, such as safety rules and customs processes, often add layers of complexity and expense to the supply chain. Additionally, as e-commerce has grown so quickly, customer behaviour has changed and with it, the need for logistics providers to provide shorter delivery times and more visibility throughout the shipping process.

Market Competitive Landscape

The top five corporations own 16.09% of the fragmented North American freight and logistics market. C.H. Robinson, Deutsche Post DHL Group, FedEx, Kuehne + Nagel, and United Parcel Service are the leading companies in this area.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | By End User, By Logistics Function

|

| Regions covered | US, Canada, Rest of North America

|

| Companies Covered | C.H Robinson, DB Schenker, Deutsche Post, DHL Group DSV A/S (De Sammensluttede Vognmænd af Air and Sea) Expeditors International, FedEx, GXO Logistics, J.B.Hunt, Transport Services Inc. Kuehne + Nagel Ryder Systems, United Parcel Service, XPO Logistics Others,

|

COVID-19 Impact on North America Freight and Logistics Market

The COVID-19 pandemic impacted on the North American freight and logistics market. supply chains were disrupted by widespread lockdowns and limitations, which decreased demand for some commodities and changed customer behaviour to online purchasing. Due to customers' desire for contactless delivery choices, this unexpected spike in e-commerce put an unprecedented burden on logistics networks, especially last-mile delivery services. In addition, travel restrictions and border closures made it more difficult for products to move, which made traffic at ports and border crossings already worse. The pandemic also revealed weaknesses in supply networks, which forced businesses to reconsider their sourcing plans and allocate funds for resilience initiatives like digitalization and diverse inventories.

Key Target Audience:

- Manufacturers and Producers

- Retailers and Wholesalers

- E-commerce Companies

- Transportation Companies

- Government Agencies

- Investors and Financial Institutions

- Supply Chain Managers and Professionals

- International Trade Organizations

- Technology Providers

- Consumers

- Others

Our in-depth analysis of the North America Freight and Logistics Market includes the following segments:

|

By End User: |

Agriculture, Fishing and Forestry

Construction

Manufacturing

Oil and Gas, Mining and Quarrying

Wholesale and Retail Trade

Others

|

|

By Logistics Function: |

By Destination Type

Freight Forwarding

By Mode of Transport

Warehousing and Storage

|

|

By Region: |

US

Canada

Rest of North America

|

Key Topics Covered in the Report:

- North America Freight and Logistics Market Size (FY’2024-FY’2033)

- Overview of North America Freight and Logistics Market

- Segmentation of North America Freight and Logistics Market By End User (Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others)

- Segmentation of North America Freight and Logistics Market By Logistics Function (Courier, Express and Parcel, Freight Forwarding, Warehousing and Storage)

- Expansion Analysis of North America Freight and Logistics Market

- Problems and Obstacles in North America Freight and Logistics Market

- Competitive Landscape in the North America Freight and Logistics Market

- Impact of COVID-19 and Demonetization on North America Freight and Logistics Market

- Details on Current Investment in North America Freight and Logistics Market

- Competitive Analysis of North America Freight and Logistics Market

- Prominent Players in the North America Freight and Logistics Market

- SWOT Analysis of North America Freight and Logistics Market

- North America Freight and Logistics Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

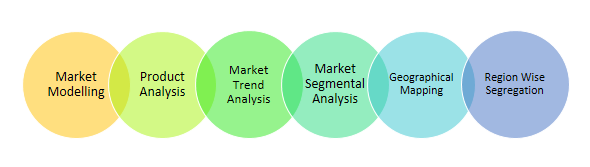

1.2. Market segment analysis

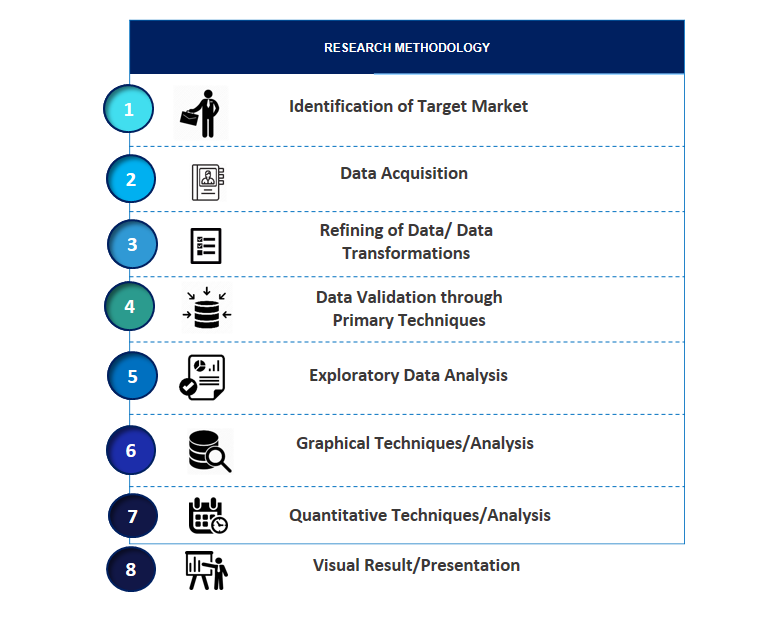

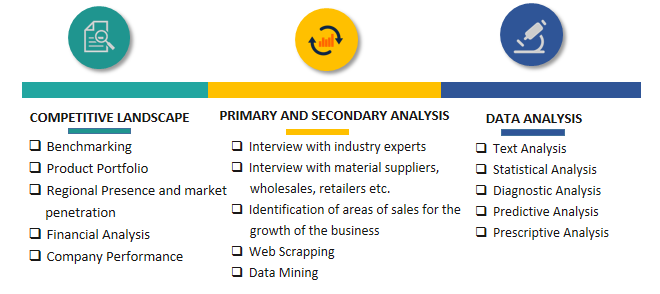

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

4.2. COVID-19 Impacts of the North America Freight And Logistics Market

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. North America Freight And Logistics Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in North America Freight And Logistics Market

7. North America Freight And Logistics Market, By End User (USD Million)

7.1. North America Freight And Logistics Market Value Share and Forecast, By End User, 2024-2033

7.2. Agriculture, Fishing and Forestry

7.3. Construction

7.4. Manufacturing

7.5. Oil and Gas, Mining and Quarrying

7.6. Wholesale and Retail Trade

7.7. Others

8. North America Freight And Logistics Market, By Logistics Function (USD Million)

8.1. North America Freight And Logistics Market Value Share and Forecast, By Logistics Function, 2024-2033

8.2. Courier, Express and Parcel

8.2.1. By Destination Type

(a) Domestic

(b) International

(c) Freight Forwarding

8.2.2. By Mode of Transport

(a) Air

(b) Pipelines

(c) Rail

(d) Road

(e) Sea and Inland Waterways

8.2.3. Warehousing and Storage

8.2.4. By Temperature Control

(a) Non-Temperature Control

(b) Temperature Controlled

9. North America Freight And Logistics Market Forecast, 2020-2033 (USD Million)

9.1. North America Freight And Logistics Market Size and Market Share

10. North America Freight And Logistics Market, By End User, 2020-2033 (USD Million)

10.1. North America Freight And Logistics Market Size and Market Share By End User (2020-2026)

10.2. North America Freight And Logistics Market Size and Market Share By End User (2027-2033)

11. North America Freight and Logistics Market, By Logistics Function, 2020-2033 (USD Million)

11.1. North America Freight And Logistics Market Size and Market Share By Logistics Function (2020-2026)

11.2. North America Freight And Logistics Market Size and Market Share By Logistics Function (2027-2033)

12. North America Freight And Logistics Market, By Region, 2020-2033 (USD Million)

12.1. North America Freight And Logistics Market Size and Market Share By Region (2020-2026)

12.2. North America Freight And Logistics Market Size and Market Share By Region (2027-2033)

12.3. US

12.4. Canada

12.5. Rest of North America

13. Company Profile

13.1. C.H Robinson

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. DB Schenker

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Deutsche Post DHL Group

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Expeditors International

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. FedEx

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. GXO Logistics

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. J.B.Hunt Transport Services Inc.

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Kuehne + Nagel

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. Ryder Systems

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. United Parcel Service

13.11.1. Company details

13.11.2. Financial outlook

13.11.3. Product summary

13.11.4. Recent developments

13.12. XPO Logistics

13.12.1. Company details

13.12.2. Financial outlook

13.12.3. Product summary

13.12.4. Recent developments

13.13. Others

14. List of Abbreviations

15. Reference Links

16. Conclusion

17. Research Scope

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.