Refrigerated Warehousing Market Introduction and Overview

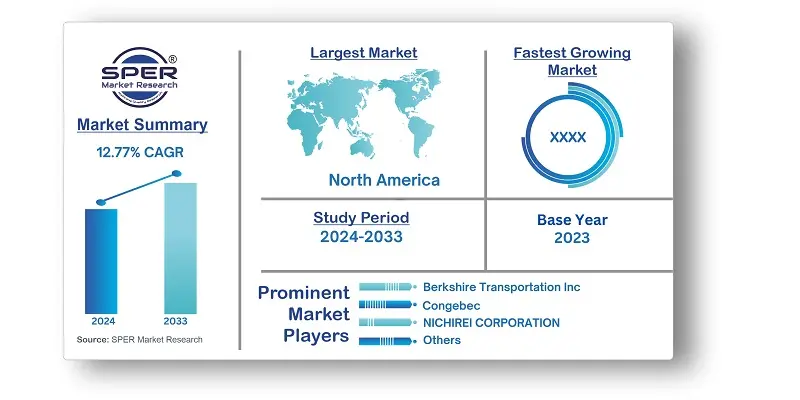

According to SPER Market Research, the Global Refrigerated Warehousing Market is estimated to reach USD 525.09 billion by 2033 with a CAGR of 12.77%.

The report includes an in-depth analysis of the Global Refrigerated Warehousing Market, including market size and trends, product mix, Applications, and supplier analysis. Many different types of businesses employ cold storage, sometimes known as refrigerated warehousing. Cold storage is utilized whenever a restricted substance—such as food, medication, or volatile chemicals—needs to be kept at a low temperature. It prevents materials and chemicals from degrading frequently so that businesses can follow the rules and laws that are specific to the item in question. Manufacturers may store their goods in cold storage prior to delivery to final consumers. Meatpackers frequently use either on- or off-site cold storage. Some end users may be able to store goods they have received but not yet utilized in a cold storage facility. A city's fast-food franchise owner may employ refrigerated warehousing if they have multiple restaurants to staff.

- June 2023; Americold Realty Trust, Inc. partnered with Canadian Pacific Kansas City (CPKC), a logistics and transportation firm that manages an essential rail network that links the United States and Canada. By working together, both businesses would improve the food transportation services they offer and make it easier to carry different types of food and other goods to and from Mexico.

- June 2023; Morning Foods, a business that specializes in the manufacturing and distribution of premium breakfast and bakery goods, was fully acquired by Burris Logistics. Customers of Burris Logistics' subsidiary Honor Foods would be able to purchase Sunny Morning's products thanks to this transaction.

- February 2023; A cutting-edge strategic service called Lineage Fresh was launched in Europe by Lineage Logistics Holdings, LLC. With this introduction, the company would be able to provide leading farmers, grocers, and importers of fresh fruit and produce with state-of-the-art storage solutions.

Market Opportunities and Challenges

A number of businesses that provide healthcare services are putting a lot of effort into growing and expanding the capacity of their refrigerated warehouses, which in turn helps the market grow and will probably lead to the creation of profitable prospects. A number of refrigerated warehousing companies have started concentrating on employing technology innovations to turn their current refrigerated warehousing facilities into completely automated profit centers. Increased pelleting capacity and different processes are probably going to lead to increased demand and lots of room for market expansion.

In addition, rising urbanization and shifting consumer tastes and preferences are driving up demand for perishable goods in emerging economies. Investments in security systems, pelleting caps, and refrigeration equipment are all necessary for chilled warehousing. Frequent power outages and inadequate storage facilities are two of the biggest problems facing enterprises. There are instances when the industrial farms' remote locations reduce worker productivity. These inadequate infrastructure facilities could hinder market expansion. Capacity, refrigerated vehicles, racking systems, and other items are needed to set up a fully functional refrigerated warehouse unit. These prerequisites result in an extremely large initial investment. Therefore, this high initial set-cost could hinder market expansion.

Market Competitive Landscape

There are a number of significant businesses in the competitive and fragmented Refrigerated Warehousing market. Americold Logistics Inc., Berkshire Transportation Inc., CONESTOGA COLD STORAGE, Congebec, Interstate Cold Storage, Kloosterboer, LINEAGE LOGISTICS HOLDING, NICHIREI CORPORATION, Snowman are a few of the top companies in the sector.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | By Type, By Ownership, By Temperature, By Application, By Technology

|

| Regions covered | North America, Asia-Pacific, Latin America, Middle East & Africa and Europe

|

| Companies Covered | Americold Logistics Inc., Berkshire Transportation Inc., CONESTOGA COLD STORAGE, Congebec, Interstate Cold Storage, Kloosterboer, LINEAGE LOGISTICS HOLDING, NICHIREI CORPORATION, Snowman

|

COVID-19 Impact on Global Refrigerated Warehousing Market

Demand for the services provided by refrigeration companies has increased along with the demand for pharmaceuticals and other necessities. However, because of the limitations, the supply chain is disrupted, making demand and supply chain management the main difficulty. It has been challenging to handle items in large quantities because of worker safety and upholding safety regulations. This made the installation of automated material handling systems necessary for numerous cold storages. Although the increase in demand is a good thing, some cold storage facilities are finding it difficult to keep up with the demand since they are not built to handle it. Governments are making investments in supply chains and cold storage to upgrade the infrastructure and improve it.

Key Target Audience:

- Producers of Perishables

- Beverage Companies

- Pharmaceutical Companies

- Frozen Food Manufacturers

- E-commerce Grocery Businesses

- Restaurant Chains and Food Distributors

- Importers and Exporters of Perishables

Our in-depth analysis of the Refrigerated Warehousing Market includes the following segments:

|

By Type: |

Cold Storage

Frozen Storage

|

|

By Ownership: |

Private

Public

Bonded

|

|

By Filter Media: |

Chilled

Frozen

|

|

By Application: |

Fruits & Vegetables

Bakery & Confectionery

Milk & Dairy Products

Meat & Seafood

Food & Beverages

|

|

By Technology: |

Programmable Logic Controller (PLC)

Evaporation Cooling

Vapour Freezing

Blast Freezing

|

Key Topics Covered in the Report:

- Global Refrigerated Warehousing Market Size (FY’2024-FY’2033)

- Overview of Global Refrigerated Warehousing Market

- Segmentation of Global Refrigerated Warehousing Market By Type (Cold Storage, Frozen Storage)

- Segmentation of Global Refrigerated Warehousing Market By Ownership (Private, Public, Bonded)

- Segmentation of Global Refrigerated Warehousing Market By Temperature (Chilled, Frozen)

- Segmentation of Global Refrigerated Warehousing Market By Application (Fruits & Vegetables, Bakery & Confectionery, Milk & Dairy Products, Meat & Seafood, Food & Beverages)

- Segmentation of Global Refrigerated Warehousing Market By Technology (Programmable Logic Controller, Evaporation Cooling, Vapour Freezing, Blast Freezing)

- Statistical Snap of Global Refrigerated Warehousing Market

- Expansion Analysis of Global Refrigerated Warehousing Market

- Problems and Obstacles in Global Refrigerated Warehousing Market

- Competitive Landscape in the Global Refrigerated Warehousing Market

- Impact of COVID-19 and Demonetization on Global Refrigerated Warehousing Market

- Details on Current Investment in Global Refrigerated Warehousing Market

- Competitive Analysis of Global Refrigerated Warehousing Market

- Prominent Players in the Global Refrigerated Warehousing Market

- SWOT Analysis of Global Refrigerated Warehousing Market

- Global Digital Refrigerated Warehousing Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

4.2. COVID-19 Impacts of the Global Refrigerated Warehousing Market.

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Refrigerated Warehousing Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Refrigerated Warehousing Market

7. Global Refrigerated Warehousing Market, By Type (USD Million) 2020-2033

7.1. Global Refrigerated Warehousing Market Size, Share and Forecast, By Type, 2020-2026

7.2. Global Refrigerated Warehousing Market Size, Share and Forecast, By Type, 2027-2033

7.3. Cold Storage

7.4. Frozen Storage

8. Global Refrigerated Warehousing Market, By Ownership (USD Million) 2020-2033

8.1. Global Refrigerated Warehousing Market Size, Share and Forecast, By Ownership, 2020-2026

8.2. Global Refrigerated Warehousing Market Size, Share and Forecast, By Ownership, 2027-2033

8.3. Private

8.4. Public

8.5. Bonded

9. Global Refrigerated Warehousing Market, By Temperature (USD Million) 2020-2033

9.1. Global Refrigerated Warehousing Market Size, Share and Forecast, By Temperature, 2020-2026

9.2. Global Refrigerated Warehousing Market Size, Share and Forecast, By Temperature, 2027-2033

9.3. Chilled

9.4. Frozen

10. Global Refrigerated Warehousing Market, By Application (USD Million) 2020-2033

10.1. Global Refrigerated Warehousing Market Size, Share and Forecast, By Application, 2020-2026

10.2. Global Refrigerated Warehousing Market Size, Share and Forecast, By Application, 2027-2033

10.3. Fruits & Vegetables

10.4. Bakery & Confectionery

10.5. Milk & Dairy Products

10.6. Meat & Seafood

10.7. Food & Beverages

11. Global Refrigerated Warehousing Market, By Technology (USD Million) 2020-2033

11.1. Global Refrigerated Warehousing Market Size, Share and Forecast, By Technology, 2020-2026

11.2. Global Refrigerated Warehousing Market Size, Share and Forecast, By Technology, 2027-2033

11.3. Programmable Logic Controller (PLC)

11.4. Evaporation Cooling

11.5. Vapour Freezing

11.6. Blast Freezing

12. Global Refrigerated Warehousing Market Forecast, 2020-2033 (USD Million)

12.1. Global Refrigerated Warehousing Market Size and Market Share

13. Global Refrigerated Warehousing, By Region, 2020-2033 (USD Million)

13.1. Global Refrigerated Warehousing Market Size and Market Share By Region (2020-2026)

13.2. Global Refrigerated Warehousing Market Size and Market Share By Region (2027-2033)

13.3. Asia-Pacific

13.3.1. Australia

13.3.2. China

13.3.3. India

13.3.4. Japan

13.3.5. South Korea

13.3.6. Rest of Asia-Pacific

13.4. Europe

13.4.1. France

13.4.2. Germany

13.4.3. Italy

13.4.4. Spain

13.4.5. United Kingdom

13.4.6. Rest of Europe

13.5. Middle East and Africa

13.5.1. Kingdom of Saudi Arabia

13.5.2. United Arab Emirates

13.5.3. Qatar

13.5.4. South Africa

13.5.5. Egypt

13.5.6. Morocco

13.5.7. Nigeria

13.5.8. Rest of Middle-East and Africa

13.6. North America

13.6.1. Canada

13.6.2. Mexico

13.6.3. United States

13.7. Latin America

13.7.1. Argentina

13.7.2. Brazil

13.7.3. Rest of Latin America

14. Company Profile

14.1. Americold Logistics Inc.

14.1.1. Company details

14.1.2. Financial outlook

14.1.3. Product summary

14.1.4. Recent developments

14.2. Berkshire Transportation Inc.

14.2.1. Company details

14.2.2. Financial outlook

14.2.3. Product summary

14.2.4. Recent developments

14.3. CONESTOGA COLD STORAGE

14.3.1. Company details

14.3.2. Financial outlook

14.3.3. Product summary

14.3.4. Recent developments

14.4. Congebec

14.4.1. Company details

14.4.2. Financial outlook

14.4.3. Product summary

14.4.4. Recent developments

14.5. Interstate Cold Storage

14.5.1. Company details

14.5.2. Financial outlook

14.5.3. Product summary

14.5.4. Recent developments

14.6. Kloosterboer

14.6.1. Company details

14.6.2. Financial outlook

14.6.3. Product summary

14.6.4. Recent developments

14.7. LINEAGE LOGISTICS HOLDING

14.7.1. Company details

14.7.2. Financial outlook

14.7.3. Product summary

14.7.4. Recent developments

14.8. NICHIREI CORPORATION

14.8.1. Company details

14.8.2. Financial outlook

14.8.3. Product summary

14.8.4. Recent developments

14.9. Snowman

14.9.1. Company details

14.9.2. Financial outlook

14.9.3. Product summary

14.9.4. Recent developments

14.10. TOYO SUISAN KAISHA LTD

14.10.1. Company details

14.10.2. Financial outlook

14.10.3. Product summary

14.10.4. Recent developments

14.11. Others

17. Conclusion

15. List of Abbreviations

16. Reference Links