Global Algae Treatment Chemical Market Introduction and Overview

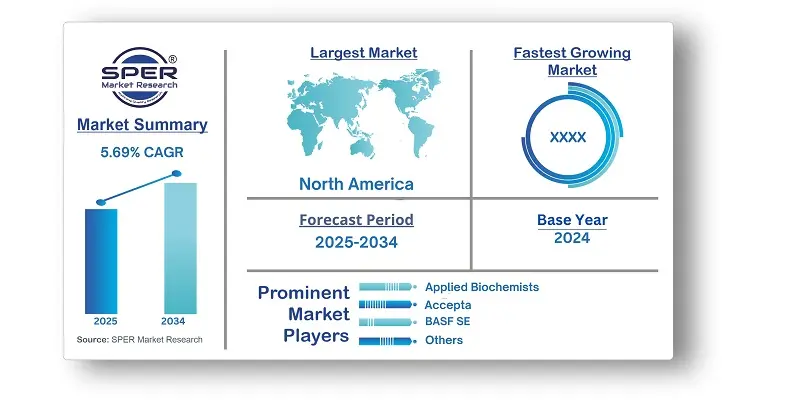

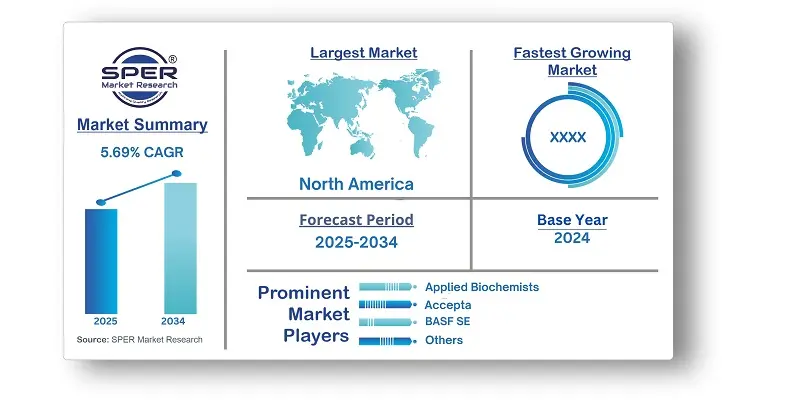

According to SPER Market Research, the Global Algae Treatment Chemical Market is estimated to reach USD 5.7 billion by 2034 with a CAGR of 5.69%.

The report includes an in-depth analysis of the Global Algae Treatment Chemical Market, including market size and trends, product mix, Applications, and supplier analysis. The algae treatment chemical industry focuses on producing and marketing substances that control or eliminate algae in environments like industrial sites, aquaculture, and recreational waters. Market growth is driven by rising concerns about water quality and environmental sustainability, increasing demand for effective algae management solutions. Expansion in aquaculture and water treatment sectors, along with stricter regulations, further fuels this growth. However, challenges such as environmental toxicity and resistance development in algae strains require constant innovation and regulatory oversight. Prolonged chemical use can harm ecosystems and lead to reduced treatment effectiveness. Therefore, balancing efficacy with ecological responsibility is crucial, demanding well-regulated application and the development of environmentally safe, innovative formulations to address algae-related issues sustainably.

By Algae Type:

The algae treatment chemical market is segmented by algae types, including green algae, blue-green algae, diatoms, red algae, and others. Among these, green algae hold a dominant position due to their widespread presence in aquatic ecosystems. Their ability to thrive in various environments such as lakes, ponds, and aquariums leads to issues like water discoloration and ecological imbalance. This drives strong demand for targeted treatment solutions, including algaecides and algistats, to effectively manage and control green algae proliferation.

By Product Type:

The algae treatment chemical market is categorized by product type into algaecides, algistats, flocculants & coagulants, and pH adjusters. Among these, algaecides hold a leading position due to their crucial role in effectively controlling algal growth across a wide range of environments. They are vital for maintaining water quality and ensuring the smooth operation of industrial systems, irrigation networks, and aquatic habitats such as lakes, ponds, and pools. Growing environmental awareness and advancements in eco-friendly formulations are driving innovation and expanding opportunities in this segment.

By End Use:

The algae treatment chemical market, segmented by end-use industry, includes water treatment, aquaculture, agriculture, healthcare and pharmaceuticals, food and beverage, and others. Among these, the water treatment sector plays a critical role in combating algae-related challenges in various water bodies. Algae treatment chemicals are essential for controlling blooms, reducing fouling, and improving water quality in settings such as industrial systems, recreational waters, aquaculture, and municipal plants. Growing concerns over environmental sustainability and clean water continue to drive demand for these solutions in the water treatment industry.

By Regional Insights

The North American algae treatment chemical market plays a crucial role in addressing algae-related challenges across diverse water sources such as lakes, ponds, and reservoirs. These chemicals are essential for preventing algal blooms, maintaining water quality, and protecting aquatic ecosystems, recreational areas, and drinking water supplies. Widely used in industrial systems, aquaculture facilities, municipal treatment plants, and recreational sites, they support environmental preservation and water resource management. In the U.S., rising instances of algal blooms have heightened the demand for effective treatment solutions, driving growth in the algae treatment chemical industry.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are Applied Biochemists, Accepta, BASF SE, Biosafe Systems LLC, Italmatch Chemicals S.p.A., LG Sonic, Lonza Group, and SePRO Corporation.

Recent Developments:

On December 23, 2021, Arxada AG, a leading specialty chemicals company based in Basel, finalized its acquisition of Enviro Tech Chemical Services, Inc., a well-established manufacturer recognized for its advanced and proprietary antimicrobial and biocidal products.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Algae Type, By Product Type, By End Use Industry |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Applied Biochemists, Accepta, BASF SE, Biosafe Systems LLC, Italmatch Chemicals S.p.A., LG Sonic, Lonza Group, and SePRO Corporation. |

Key Topics Covered in the Report

- Global Algae Treatment Chemical Market Size (FY’2021-FY’2034)

- Overview of Global Algae Treatment Chemical Market

- Segmentation of Global Algae Treatment Chemical Market By Algae Type (Green algae, Blue-green algae, Diatoms, Red algae, Others)

- Segmentation of Global Algae Treatment Chemical Market By Product Type (Algaecides, Algistats, Flocculants & coagulant, pH adjusters)

- Segmentation of Global Algae Treatment Chemical Market By End-use (Water treatment, Aquaculture, Agriculture, Healthcare and Pharmaceuticals, Food and Beverage, Others)

- Statistical Snap of Global Algae Treatment Chemical Market

- Expansion Analysis of Global Algae Treatment Chemical Market

- Problems and Obstacles in Global Algae Treatment Chemical Market

- Competitive Landscape in the Global Algae Treatment Chemical Market

- Details on Current Investment in Global Algae Treatment Chemical Market

- Competitive Analysis of Global Algae Treatment Chemical Market

- Prominent Players in the Global Algae Treatment Chemical Market

- SWOT Analysis of Global Algae Treatment Chemical Market

- Global Algae Treatment Chemical Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Algae Treatment Chemical Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Algae Treatment Chemical Market

7. Global Algae Treatment Chemical Market, By Algae Type, (USD Million) 2021-2034

7.1. Green algae

7.2. Blue-green algae

7.3. Diatoms

7.4. Red algae

7.5. Others

8. Global Algae Treatment Chemical Market, By Product Type, (USD Million) 2021-2034

8.1. Algaecides

8.2. Algistats

8.3. Flocculants & coagulants

8.4. pH adjusters

9. Global Algae Treatment Chemical Market, By End-use, (USD Million) 2021-2034

9.1. Water treatment

9.2. Aquaculture

9.3. Agriculture

9.4. Healthcare and Pharmaceuticals

9.5. Food and Beverage

9.6. Others

10. Global Algae Treatment Chemical Market, (USD Million) 2021-2034

10.1. Global Algae Treatment Chemical Market Size and Market Share

11. Global Algae Treatment Chemical Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Applied Biochemists

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Accepta

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. BASF SE

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Biosafe Systems LLC

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Italmatch Chemicals S.p.A.

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. LG sonic

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Lonza Group

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. SePRO Corporation

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.