Auxins Market Introduction and Overview

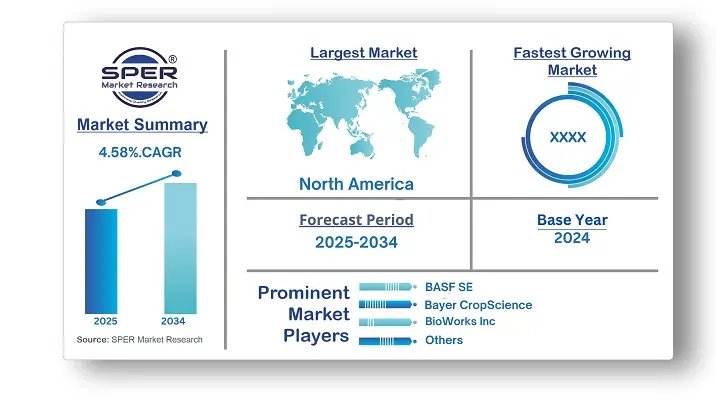

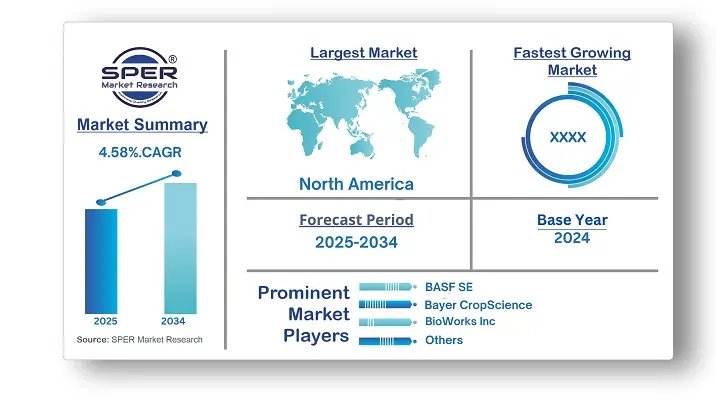

According to SPER Market Research, the Global Auxins Market is estimated to reach USD 1474.71 million by 2034 with a CAGR of 4.58%.

The report includes an in-depth analysis of the Global Auxins Market, including market size and trends, product mix, Applications, and supplier analysis. Auxins, essential plant growth hormones, play a crucial role in regulating plant development and growth. Widely used in gardening, farming, and landscaping, they promote root growth, aid in fruit production, and enhance agricultural productivity. The global auxins industry spans horticulture, agriculture, and landscaping, driven by competition among large corporations. With growing consumer demand for sustainable farming, innovations in agricultural technology, such as genetic engineering and precision farming, are improving auxin effectiveness and crop yields. As farmers seek to increase productivity while reducing environmental impact, the market for auxins continues to grow, fueled by advancements in sustainability and technology. However, The auxins market faces challenges such as regulatory hurdles and the high cost of research and development for new formulations. Additionally, there is growing concern over the environmental impact of synthetic auxins, which may hinder adoption.

By Type:

The market is divided into natural and synthetic segments, with the synthetic segment playing a crucial role in the auxins industry. This segment is expected to see significant growth, driven by the rising demand for plant growth regulators, particularly with the shift toward sustainable farming practices. Synthetic auxins are produced through advanced chemical processes, ensuring a consistent and reliable supply for applications in landscaping, horticulture, and agriculture. Ongoing research and development in this area aim to improve the efficiency and versatility of synthetic auxins, addressing various crop needs and environmental conditions, and further expanding their market presence.

By Function:

The market can be further categorized based on function into areas such as fruit development, tissue culture, weed control, fruit thinning, phototropism and gravitropism, and senescence delay. The fruit development segment leads the market, playing a crucial role in promoting the growth and maturation of fruits across various agricultural settings. This segment utilizes auxins to stimulate fruit growth, enhance fruit size, and improve fruit quality. With growing consumer demand for high-quality, aesthetically appealing fruits, this segment is expected to experience significant growth. Ongoing advancements in science and technology are also boosting the effectiveness of auxins in fruit development, catering to a wide range of fruit varieties and farming techniques, making it a promising area for innovation and market expansion.

By Application:

The market can be further divided into agriculture, scientific research, and other applications, with the agriculture segment being the most prominent. Auxins play a vital role in agriculture by regulating plant growth, with diverse uses such as enhancing crop yields, promoting root development, and supporting fruit and flower growth. In modern farming, they are crucial for managing plant development and improving productivity. As the demand for sustainable farming practices rises, auxins will continue to be essential in optimizing crop output, addressing environmental concerns, and meeting global food demands. Their role in agriculture is key to maintaining resilient and sustainable farming practices.

By Regional Insights

North America holds a strong position in the global auxins market, demonstrating significant potential for growth and development. As agriculture increasingly focuses on efficiency and sustainability, the demand for plant growth regulators like auxins is rising. Key factors driving this growth include the adoption of modern farming techniques, the rise of organic farming, and increasing consumer awareness of the benefits of auxins. Furthermore, advancements in precision farming and biotechnology are expanding opportunities for the auxins industry in the region. As a result, North America presents a favorable environment for producers and suppliers to capitalize on evolving farming practices and consumer preferences.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are BASF SE, Bayer CropScience, BioWorks Inc., Dow AgroSciences LLC (now part of Corteva Agriscience), FMC Corporation, Jiangsu Fengyuan Bioengineering Co., Ltd., Nufarm Limited, Redox Industries Limited, Sinon Corporation, SRF Limited, and Syngenta AG, among others.

Recent Developments:

In April 2020, Sumitomo Chemical Co., Ltd. acquired the South American subsidiaries of Nufarm Ltd., which operate in Brazil, Argentina, Chile, and Colombia. This acquisition is intended to strengthen Sumitomo's sales and development network in the region, enhancing the distribution of its plant growth regulator products.

In May 2022, BASF SE acquired Horta, an Italian company specializing in digital farming solutions. This acquisition allows BASF SE to expand its portfolio of agricultural solutions, addressing the increasing demand for digital farming technologies in the sector.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Function, By Application |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | BASF SE, Bayer CropScience, BioWorks Inc., Dow AgroSciences LLC (now part of Corteva Agriscience), FMC Corporation, Jiangsu Fengyuan Bioengineering Co., Ltd., Nufarm Limited, Redox Industries Limited, Sinon Corporation, SRF Limited, and Syngenta AG, among others.

|

Key Topics Covered in the Report

- Global Auxins Market Size (FY’2021-FY’2034)

- Overview of Global Auxins Market

- Segmentation of Global Auxins Market By Type (Natural, Synthesis)

- Segmentation of Global Auxins Market By Function (Fruit Development, Tissue Culture, Weed Control, Fruit Thinning, Phototropism and Gravitropism, Senescence Delay)

- Segmentation of Global Auxins Market By Application (Agriculture, Scientific Research, Others)

- Statistical Snap of Global Auxins Market

- Expansion Analysis of Global Auxins Market

- Problems and Obstacles in Global Auxins Market

- Competitive Landscape in the Global Auxins Market

- Details on Current Investment in Global Auxins Market

- Competitive Analysis of Global Auxins Market

- Prominent Players in the Global Auxins Market

- SWOT Analysis of Global Auxins Market

- Global Auxins Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Auxins Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Auxins Market

7. Global Auxins Market, By Type, (USD Million) 2021-2034

7.1. Natural

7.2. Synthesis

8. Global Auxins Market, By Function, (USD Million) 2021-2034

8.1. Fruit Development

8.2. Tissue Culture

8.3. Weed Control

8.4. Fruit Thinning

8.5. Phototropism and Gravitropism

8.6. Senescence Delay

9. Global Auxins Market, By Application, (USD Million) 2021-2034

9.1. Agriculture

9.2. Scientific Research

9.3. Others

10. Global Auxins Market, (USD Million) 2021-2034

10.1. Global Auxins Market Size and Market Share

11. Global Auxins Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. BASF SE

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Bayer CropScience

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. BioWorks Inc.

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. BASF SE

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Dow AgroSciences LLC (Now part of Corteva Agriscience)

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. FMC Corporation

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Jiangsu Fengyuan Bioengineering Co., Ltd.

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Nufarm Limited

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Redox Industries Limited

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Sinon Corporation

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. SRF Limited

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Syngenta AG

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.