Diisononyl Phthalate Market Introduction and Overview

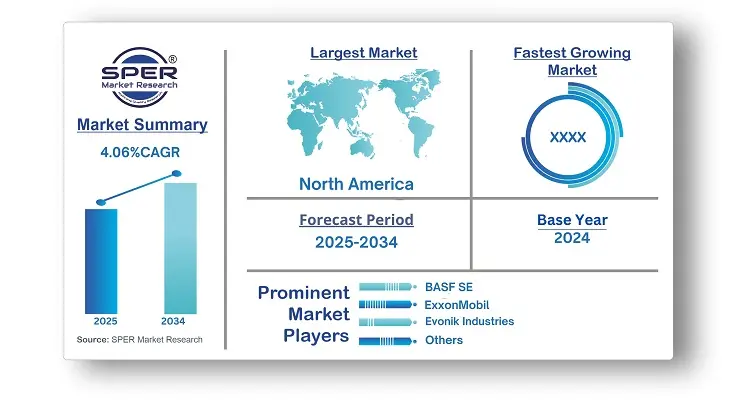

According to SPER Market Research, the Global Diisononyl Phthalate Market is estimated to reach USD 4.85 billion by 2034 with a CAGR of 4.06%.

The report includes an in-depth analysis of the Global Diisononyl Phthalate Market, including market size and trends, product mix, Applications, and supplier analysis. The global diisononyl phthalate market was valued at USD 3.26 billion in 2024 and is expected to grow at a 4.06% CAGR in revenue from 2025 to 2034. The diisononyl phthalate (DINP) industry is driven by an increase in demand for coatings and adhesives. As the construction, automotive, and packaging industries expand, there will be an increased demand for high-performance coatings and adhesives.

By Type Insights

In 2024, the PVC type category held the largest revenue share and dominated the market. This segment is essential for the DINP market, serving various applications where flexibility and durability are important. Diisononyl phthalate (DINP) is mainly used as a plasticizer in producing PVC products, improving their flexibility and performance. This includes uses in construction materials, automotive parts, consumer goods, and medical devices. The extensive use of PVC in many different sectors is what drives demand in this market.

Acrylics are a specific type of plasticizer used in applications like flexible PVC and rubber products. They are valued for their clarity, UV resistance, and ability to enhance material flexibility and durability. Because of their efficacy and affordability, acrylics are widely used in sectors like consumer products, construction, and automobiles. Their environmentally friendly nature makes them a preferred choice for manufacturers.

By Application Insights

Flooring and wall covering had the largest revenue share in 2024. DINP is being used in a variety of applications because to the demand for long-lasting and stylish interior solutions. DINP is a popular plasticiser for creating vinyl flooring, wallpaper, and synthetic leather products for usage in homes, businesses, and industries. It enhances the flexibility, durability, and lifespan of these products. By being a plasticizer, DINP simplifies the processing, installation, and maintenance of vinyl flooring and wall coverings, offering consumers resilient and versatile interior design choices. It also supports the need for sustainable and low-maintenance spaces.

Regional Insights

Asia Pacific led the market and held the largest share in 2024. This is due to growing construction and automotive sectors in the region and increasing demand for coated fabrics for flooring and wall-covering. Favorable conditions like ample land, low raw material and labor costs, and supportive government policies also contribute to high production volumes of diisononyl phthalate in countries like China and India.

China plays a crucial role in the global diisononyl phthalate market, impacting market dynamics significantly. Its dominance is due to high production capacity, low labor costs, and raw material availability, fostering competitive pricing and production volumes. Demand in China is driven by rising construction projects and the automotive industry, alongside the growth of manufacturing plants.

Market Competitive Landscape

Aekyung, BASF SE, Eastman Chemical Company, Evonik Industries AG, and Exxon Mobil Corporation are key players in the diisononyl phthalate industry due to their experience, innovative products, and global reach. Aekyung, based in South Korea, provides high-quality diisononyl phthalate (DINP) as a reliable plasticizer trusted by various industries. BASF SE, a global leader in chemicals, is known for producing and distributing DINP, which is important for many applications, including construction, automotive, and consumer goods, while focusing on innovation and sustainability.

Recent Developments:

BASF SE committed to supply the technology needed to produce isononyl alcohol (INA) in China in October 2023. At the ZRCC refinery and petrochemical complex, NZRCC is able to construct a large-scale INA production unit thanks to the licence agreement. The factory will begin operations in 2026 and has an annual capacity of 200,000 tonnes. Plasticisers for PVC that have superior toxicological profiles to alternative alternatives are made using INA.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Application |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | BASF SE, ExxonMobil, Evonik Industries, LG Chem, Mitsubishi Chemical Holdings Corporation, KLJ Group, Azelis Group, AEKYUNG, Nan Ya Plastics, UPC Technology Corporation.

|

Key Topics Covered in the Report

- Global Diisononyl Phthalate Market Size (FY’2021-FY’2034)

- Overview of Global Diisononyl Phthalate Market

- Segmentation of Global Diisononyl Phthalate Market By Type (PVC, Acrylics, Polyurethanes, Other Type)

- Segmentation of Global Diisononyl Phthalate Market By Application (Flooring & Wall Covering, Wires & Cables, Films & Sheets, Coated Fabrics, Consumer Goods, Other Applications)

- Statistical Snap of Global Diisononyl Phthalate Market

- Expansion Analysis of Global Diisononyl Phthalate Market

- Problems and Obstacles in Global Diisononyl Phthalate Market

- Competitive Landscape in the Global Diisononyl Phthalate Market

- Details on Current Investment in Global Diisononyl Phthalate Market

- Competitive Analysis of Global Diisononyl Phthalate Market

- Prominent Players in the Global Diisononyl Phthalate Market

- SWOT Analysis of Global Diisononyl Phthalate Market

- Global Diisononyl Phthalate Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Diisononyl Phthalate Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Diisononyl Phthalate Market

7. Global Diisononyl Phthalate Market, By Type (USD Million) 2021-2034

7.1. PVC

7.2. Acrylics

7.3. Polyurethanes

7.4. Other Types

8. Global Diisononyl Phthalate Market, By Application (USD Million) 2021-2034

8.1. Flooring & Wall Covering

8.2. Wires & Cables

8.3. Films & Sheets

8.4. Coated Fabrics

8.5. Consumer Goods

8.6. Other Applications

9. Global Diisononyl Phthalate Market, (USD Million) 2021-2034

9.1. Global Diisononyl Phthalate Market Size and Market Share

10. Global Diisononyl Phthalate Market, By Region, (USD Million) 2021-2034

10.1. sia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. BASF SE

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. ExxonMobil

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Evonik Industries

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. LG Chem

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. Mitsubishi Chemical Holdings Corporation

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. KLJ Group

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Azelis Group

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. AEKYUNG

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Nan Ya Plastics

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. UPC Technology Corporation

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.