Electroactive Polymer Market Introduction and Overview

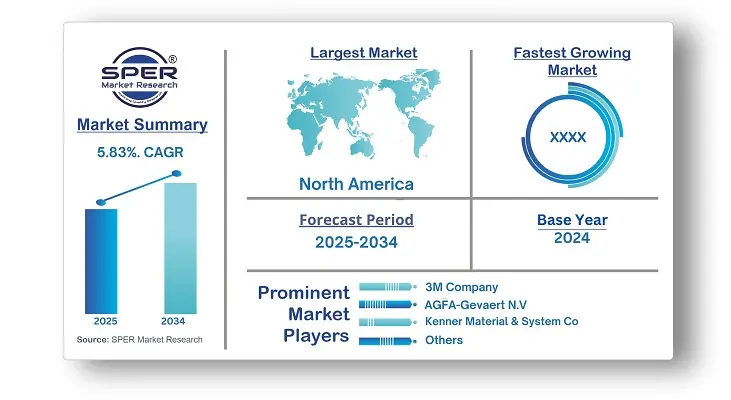

According to SPER Market Research, the Global Electroactive Polymer Market is estimated to reach USD 6.20 billion by 2034 with a CAGR of 5.83%.

The report includes an in-depth analysis of the Global Electroactive Polymer Market, including market size and trends, product mix, Applications, and supplier analysis. This growth is driven by the rapid industrialization and urbanization in developing regions, which are boosting demand across various end-use industries. Additionally, the increasing use of electroactive polymers in the automotive and electronics sectors, owing to their lightweight and durable characteristics, is further fueling market expansion. Furthermore, the growing significance of piezoelectric and ferromagnetic materials in electronic devices, coupled with advancements in conductive technologies, also plays a crucial role in the market's development. However, The electroactive polymer market faces challenges such as high production costs and limited scalability of manufacturing processes. Additionally, concerns over the long-term stability and reliability of these materials in harsh environments can hinder widespread adoption.

By Type:

Conductive polymers lead the global electroactive polymers market, capturing the largest share of revenue in 2024. This growth is driven by rising demand from various industries, especially electronics and energy storage. Their unique attributes, such as flexibility, lightweight nature, and excellent conductivity, make them ideal for use in sensors, actuators, and biomedical devices. Additionally, the growing need for advanced materials to replace traditional metals boosts their market appeal, contributing to strong growth prospects.

Inherently conductive polymers (ICPs) are anticipated to experience steady growth during the forecast period, thanks to their ability to deliver bulk conductivity and their versatility across various applications.

By Application:

The ESD and EMI protection segment led the market, capturing the largest revenue share in 2024, primarily driven by the growing need for protection against electrostatic discharge and electromagnetic interference in electronic devices. As consumer electronics continue to expand, the demand for materials that can protect sensitive components from damage becomes increasingly important. Additionally, the use of polyaniline and carbon black-filled polymers improves the effectiveness of ESD and EMI shielding, fueling substantial investment and innovation in this area.

By Regional Insights

The Asia Pacific region dominated the global electroactive polymers market in 2024, driven by rapid industrialization and urbanization. The growing production of electronic devices, combined with an expanding middle-class population, is fueling demand for advanced materials. Additionally, the region's robust manufacturing base and government initiatives supporting research and development further enhance market opportunities. The wide-ranging applications of electroactive polymers in industries such as automotive, healthcare, and consumer electronics also contribute to the region's leadership in this market.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are 3M Company, AGFA-Gevaert N.V., Heraeus Holding GmbH, Kenner Material & System Co., Ltd, Merck Group, Parker Hannifin Corporation, PolyOne Corporation (now Avient Corporation), RTP Company, Solvay S.A., The Lubrizol Corporation, and others.

Recent Developments:

In January 2024, Datwyler announced a partnership to advance the production of Dielectric Elastomer Actuators (DEAs) using electroactive polymers (EAP). This collaboration aims to move EAP technology from research into mass production by mid-2024, with a focus on energy-efficient and sustainable actuators. The initiative includes the launch of a development kit at CES 2024, encompassing the entire value chain from raw materials to integrated control modules, enabling ongoing optimization and integration into industries such as automotive and healthcare.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Application |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | 3M Company, AGFA-Gevaert N.V., Heraeus Holding GmbH, Kenner Material & System Co., Ltd, Merck Group, Parker Hannifin Corporation, PolyOne Corporation (now Avient Corporation), RTP Company, Solvay S.A., The Lubrizol Corporation, and others.

|

Key Topics Covered in the Report

- Global Electroactive Polymer Market Size (FY’2021-FY’2034)

- Overview of Global Electroactive Polymer Market

- Segmentation of Global Electroactive Polymer Market By Type (Conductive Polymers, Inherently Dissipative Polymers (IDPs), Inherently Conductive Polymers (ICPs), Others}

- Segmentation of Global Electroactive Polymer Market By Application (Actuators, Sensors, ESD & EMI Protection, Antistatic Packaging, Others)

- Statistical Snap of Global Electroactive Polymer Market

- Expansion Analysis of Global Electroactive Polymer Market

- Problems and Obstacles in Global Electroactive Polymer Market

- Competitive Landscape in the Global Electroactive Polymer Market

- Details on Current Investment in Global Electroactive Polymer Market

- Competitive Analysis of Global Electroactive Polymer Market

- Prominent Players in the Global Electroactive Polymer Market

- SWOT Analysis of Global Electroactive Polymer Market

- Global Electroactive Polymer Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Electroactive Polymer Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Electroactive Polymer Market

7. Global Electroactive Polymer Market, By Type, (USD Million) 2021-2034

7.1. Conductive Polymers

7.2. Inherently Dissipative Polymers (IDPs)

7.3. Inherently Conductive Polymers (ICPs)

7.4. Others

8. Global Electroactive Polymer Market, By Application, (USD Million) 2021-2034

8.1. Actuators

8.2. Sensors

8.3. ESD & EMI Protection

8.4. Antistatic Packaging

8.5. Others

9. Global Electroactive Polymer Market, (USD Million) 2021-2034

9.1. Global Electroactive Polymer Market Size and Market Share

10. Global Electroactive Polymer Market, By Region, 2021-2034 (USD Million)

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. 3M Company

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. AGFA-Gevaert N.V.

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Heraeus Holding GmbH

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Kenner Material & System Co., Ltd

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. Merck Group

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Parker Hannifin Corporation

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. PolyOne Corporation (now Avient Corporation)

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. RTP Company

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Solvay S.A.

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. The Lubrizol Corporation

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links