Gas Treating Amine Market Introduction and Overview

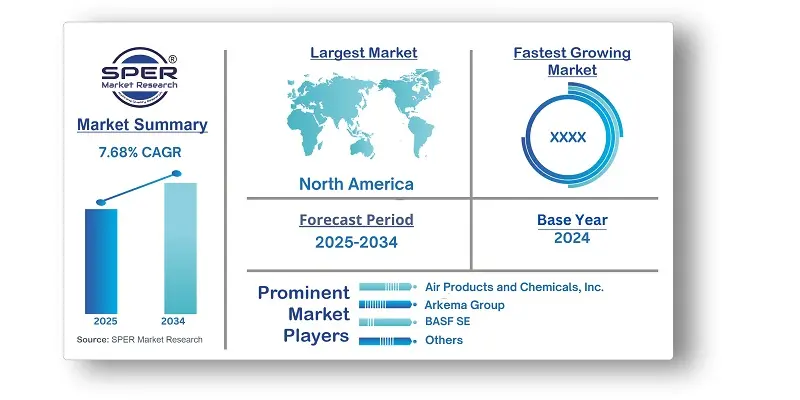

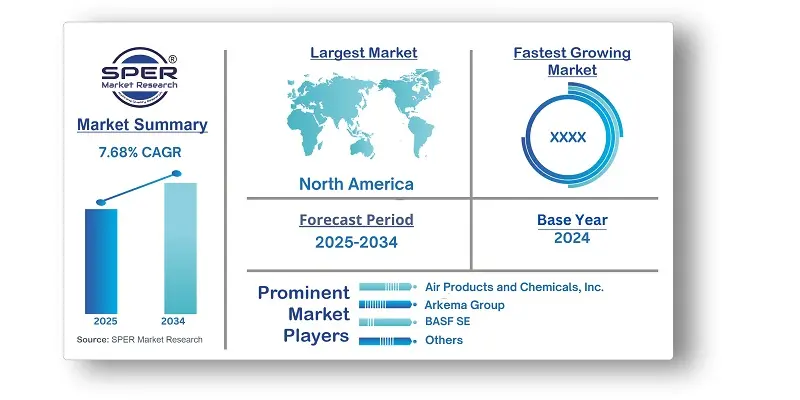

According to SPER Market Research, the Global Gas Treating Amine Market is estimated to reach USD 7.2 billion by 2034 with a CAGR of 7.68%.

The report includes an in-depth analysis of the Global Gas Treating Amine Market, including market size and trends, product mix, Applications, and supplier analysis. The market focuses on the production, distribution, and use of specialized amines designed for purifying and processing various gas streams. These compounds are essential for selectively removing impurities like hydrogen sulfide (Hâ‚‚S) and carbon dioxide (COâ‚‚) from natural gas, refinery gases, biogas, and industrial emissions. Their role is critical in ensuring gas quality, operational safety, and environmental compliance across sectors such as oil and gas, petrochemicals, power generation, and renewable energy. As global energy demands rise and environmental regulations tighten, the demand for efficient gas purification technologies is growing, driving strong market expansion and emphasizing the shift toward cleaner energy sources. The Gas Treating Amine Market faces challenges from equipment corrosion due to the corrosive nature of amines, leading to safety risks and costly maintenance. Additionally, improper handling of amines can cause environmental pollution, highlighting the need for sustainable practices.

By Type:

The market, segmented into monoethanolamide (MEA), diethanolamine (DEA), ethanolamine (ETA), and others, sees MEA as the leading and fastest-growing segment. This growth is largely driven by MEA’s proven versatility and high efficiency in gas treatment applications, especially for removing acidic gases like hydrogen sulfide and carbon dioxide. Its widespread adoption across industries highlights its reliability and effectiveness, making it the preferred choice in gas purification processes and fueling its continued expansion in the global market.

By Application:

The gas treating amine market, segmented by applications such as natural gas sweetening, biogas purification, refinery gas treatment, and acid gas removal (AGR), identifies natural gas sweetening as the fastest-growing segment. This growth is primarily driven by the rising global demand for natural gas and the expansion of exploration and production activities. Moreover, increasingly strict environmental regulations requiring lower emissions and cleaner energy sources are further encouraging the adoption of amine-based technologies for effective removal of impurities like hydrogen sulfide (Hâ‚‚S) and carbon dioxide (COâ‚‚) from natural gas streams.

By End User:

In the gas treating amine market, key end-users include the oil and gas industry, refining, power generation, renewable energy, and others, with the oil and gas segment standing out as the fastest growing. This growth is driven by the rising global demand for natural gas as a cleaner energy source, prompting greater use of gas treating amines in processing operations. Additionally, strict environmental regulations and increased investments in shale gas and unconventional resource development are further fueling demand in this sector.

By Regional Insights

Asia Pacific emerged as the leading region in the gas treating amine market, driven by a combination of key growth factors. The region’s rapid industrialization and urbanization have significantly increased energy demand, especially for natural gas, creating a strong need for effective gas treating technologies. Ongoing investments in infrastructure—such as pipelines, refineries, and power plants—are further propelling demand for amine-based gas treatment solutions. Additionally, a growing population and rising middle class continue to boost natural gas consumption, reinforcing the need for advanced purification methods to meet environmental standards and ensure energy security.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are Air Products and Chemicals, Inc., Arkema Group, BASF SE, Chevron Phillips Chemical Company LLC, Clariant AG, Dow Chemical Company, Evonik Industries AG, ExxonMobil Corporation, Huntsman Corporation, INEOS Group Holdings S.A., Linde plc, Mitsubishi Gas Chemical Company, Nalco Champion (Ecolab Inc.), SABIC (Saudi Basic Industries Corporation), Others.

Recent Developments:

In December 2023, ExxonMobil Upstream Research introduced a cutting-edge inlet feed gas conditioning technology designed to mitigate amine solvent foaming in gas treating facilities, especially those upstream of LNG production. This innovation tackles frequent issues such as decreased gas throughput and the risk of plant shutdowns caused by solvent carryover.

In February 2024, bp and BASF signed a license agreement for BASF’s OASE® white gas treating technology to support carbon dioxide capture at bp’s planned blue hydrogen project, H2Teesside. This technology is designed to enhance energy efficiency and enable CO₂ capture rates of up to 99.99%. Using an amine-based solvent, the OASE process separates CO₂ from hydrogen-rich gas for storage, with the solvent being regenerated and reused in the system.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Film Base, By End User |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Air Products and Chemicals, Inc., Arkema Group, BASF SE, Chevron Phillips Chemical Company LLC, Clariant AG, Dow Chemical Company, Evonik Industries AG, ExxonMobil Corporation, Huntsman Corporation, INEOS Group Holdings S.A., Linde plc, Mitsubishi Gas Chemical Company, Nalco Champion (Ecolab Inc.), SABIC (Saudi Basic Industries Corporation), Others. |

Key Topics Covered in the Report

- Global Gas Treating Amine Market Size (FY’2021-FY’2034)

- Overview of Global Gas Treating Amine Market

- Segmentation of Global Gas Treating Amine Market By Type {(Monoethanolamide (MEA), Diethanolamine (DEA), Ethanolamine (ETA), Others}

- Segmentation of Global Gas Treating Amine Market By Application (Natural gas sweetening, Biogas purification, Refinery gas treatment, Acid Gas removal (AGR), Others)

- Segmentation of Global Gas Treating Amine Market By End User, (Oil and gas industry, Refining industry, Power generation, Renewal industry, Others)

- Statistical Snap of Global Gas Treating Amine Market

- Expansion Analysis of Global Gas Treating Amine Market

- Problems and Obstacles in Global Gas Treating Amine Market

- Competitive Landscape in the Global Gas Treating Amine Market

- Details on Current Investment in Global Gas Treating Amine Market

- Competitive Analysis of Global Gas Treating Amine Market

- Prominent Players in the Global Gas Treating Amine Market

- SWOT Analysis of Global Gas Treating Amine Market

- Global Gas Treating Amine Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Gas Treating Amine Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Gas Treating Amine Market

7. Global Gas Treating Amine Market, By Type, (USD Million) 2021-2034

7.1. Monoethanolamide (MEA)

7.2. Diethanolamine (DEA)

7.3. Ethanolamine (ETA)

7.4. Others

8. Global Gas Treating Amine Market, By Application, (USD Million) 2021-2034

8.1. Natural gas sweetening

8.2. Biogas purification

8.3. Refinery gas treatment

8.4. Acid Gas removal (AGR)

8.5. Others

9. Global Gas Treating Amine Market, By End User, (USD Million) 2021-2034

9.1. Oil and gas industry

9.2. Refining industry

9.3. Power generation

9.4. Renewal industry

9.5. Others

10. Global Gas Treating Amine Market, (USD Million) 2021-2034

10.1. Global Gas Treating Amine Market Size and Market Share

11. Global Gas Treating Amine Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Air Products and Chemicals, Inc.

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Arkema Group

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. BASF SE

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Chevron Phillips Chemical Company LLC

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Clariant AG

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Dow Chemical Company

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Evonik Industries AG

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. ExxonMobil Corporation

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Huntsman Corporation

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. INEOS Group Holdings S.A.

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Linde plc

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Mitsubishi Gas Chemical Company

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Nalco Champion (Ecolab Inc.)

12.13.1. Company details

12.13.2. Financial outlook

12.13.3. Product summary

12.13.4. Recent developments

12.14. SABIC (Saudi Basic Industries Corporation)

12.14.1. Company details

12.14.2. Financial outlook

12.14.3. Product summary

12.14.4. Recent developments

12.15. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links