High Performance Fluoropolymer Market Introduction and Overview

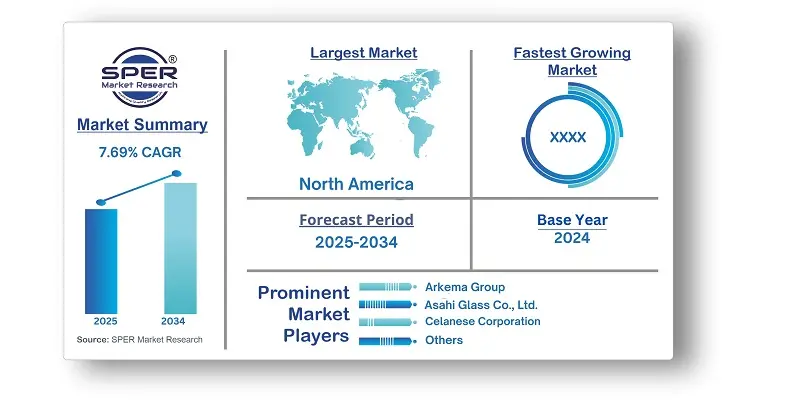

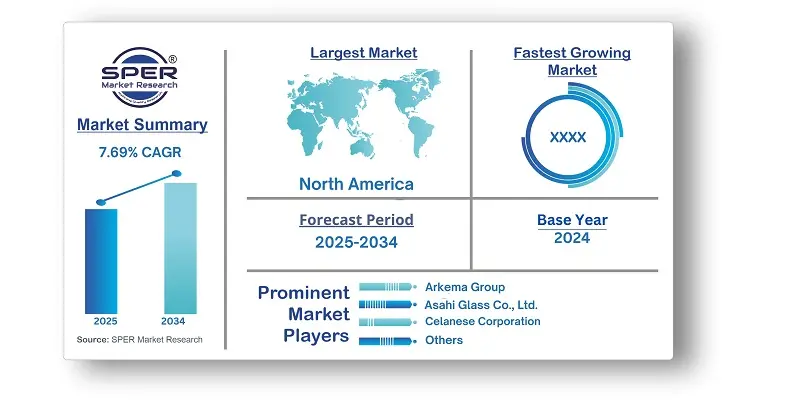

According to SPER Market Research, the Global High Performance Fluoropolymer Market is estimated to reach USD 10.12 billion by 2034 with a CAGR of 7.69%.

The report includes an in-depth analysis of the Global High Performance Fluoropolymer Market, including market size and trends, product mix, Applications, and supplier analysis. The high-performance fluoropolymer industry is essential for addressing demanding needs in sectors such as automotive, aerospace, electronics, chemical processing, and healthcare. In automotive applications, fluoropolymers improve efficiency and durability in engine components and fuel systems. In aerospace, they contribute to lightweighting and withstand extreme conditions. In electronics, they provide crucial insulation for cables, circuit boards, and semiconductors. The industry is expected to grow steadily due to technological advancements and expanding applications. Fluoropolymers also play a key role in emerging sectors like renewable energy, biotechnology, and 3D printing. They enhance solar panel efficiency, support medical innovations, and meet the precise requirements of additive manufacturing, positioning the market for ongoing growth and opportunities across various industries.

By Type:

The high-performance fluoropolymer market is categorized into several types, including polytetrafluoroethylene (PTFE), fluorinated ethylene propylene (FEP), perfluoroalkoxy alkanes (PFA), polyvinylidene fluoride (PVDF), ethylene tetrafluoroethylene (ETFE), and others. PTFE holds the largest market share and is expected to continue its strong growth. The rapid expansion of PTFE in the industry is driven by its remarkable chemical resistance, low friction, and high-temperature stability, making it highly valuable in industries like automotive, aerospace, and electronics. These properties allow PTFE to perform reliably in demanding applications that require durability and resilience under harsh conditions.

By Application:

The high-performance fluoropolymer market is divided into applications such as coatings & finishes, electrical insulation, equipment & components, additives, and others. Coatings & finishes holds a significant portion of the market and is expected to continue growing. The rapid expansion of this segment is driven by the rising demand for durable, corrosion-resistant coatings in industries like automotive, aerospace, and construction. Fluoropolymer-based coatings provide superior protection against harsh environmental conditions, abrasion, and chemical exposure, enhancing the lifespan of surfaces and lowering maintenance costs. Additionally, the versatility of fluoropolymer coatings, offering non-stick and low-friction properties, makes them ideal for various industrial uses, including food processing equipment, cookware, and medical devices.

By End User:

Asia Pacific led the high-performance fluoropolymer market in 2023, driven by significant industrialization in countries like China, Japan, and South Korea. The region's strong demand for fluoropolymer materials spans sectors such as automotive, electronics, and chemical processing. Rapid urbanization and infrastructure growth also create a need for advanced materials like fluoropolymers in coatings, insulation, and construction. Additionally, the expanding manufacturing sector and increasing investment in research and development fuel innovation and technological advancements in fluoropolymer applications. The growing consumer base and rising disposable incomes further boost demand for consumer electronics, automotive parts, and industrial machinery, all of which rely on fluoropolymers for enhanced performance and durability. The market is expected to continue its strong growth through the coming years.

By Regional Insights

Asia Pacific dominated the high-performance fluoropolymer market in 2023, driven by strong industrialization in countries like China, Japan, and South Korea. This region’s demand for fluoropolymers spans industries such as automotive, electronics, and chemical processing. Rapid urbanization and infrastructure development further fuel the need for advanced materials like fluoropolymers in coatings, insulation, and construction. The region's growing manufacturing sector and increased investment in research and development promote innovation and technological progress in fluoropolymer applications. Additionally, Asia Pacific's expanding consumer base and higher disposable incomes boost demand for consumer electronics, automotive components, and industrial machinery, all reliant on fluoropolymers for performance and durability. This makes Asia Pacific a key driver of market growth and global industry trends.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are 3M Company, AGC Inc., Arkema Group, Asahi Glass Co., Ltd. (AGC), Celanese Corporation, Chemours Company, Daikin Industries, Ltd., Dongyue Group Ltd., Gujarat Fluorochemicals Limited (GFL), Honeywell International Inc., Kuraray Co., Ltd., Saint-Gobain S.A., and others.

Recent Developments:

In April 2023, Asahi Glass, through its European division AGC Chemicals Europe, announced an expansion of its fluoropolymer capacity at the PTFE production facility in Ichihara, Japan. The EUR 240 million investment is set to bring the new plants online by mid-2025. The planned capacity, however, was not disclosed in response to a Plasteurope.com inquiry.

In September 2022, Gujarat Fluorochemicals Limited (GFL), a global leader in fluoroproducts, announced its expansion into supplying high-quality raw materials for lithium-ion batteries. This strategic move is designed to strengthen GFL's presence in the rapidly growing electric vehicle and energy storage markets.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Application, By End User |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | 3M Company, AGC Inc., Arkema Group, Asahi Glass Co., Ltd. (AGC), Celanese Corporation, Chemours Company, Daikin Industries, Ltd., Dongyue Group Ltd., Gujarat Fluorochemicals Limited (GFL), Honeywell International Inc., Kuraray Co., Ltd., Saint-Gobain S.A., and others. |

Key Topics Covered in the Report

- Global High Performance Fluoropolymer Market Size (FY’2021-FY’2034)

- Overview of Global High Performance Fluoropolymer Market

- Segmentation of Global High Performance Fluoropolymer Market By Type {(Polytetrafluoroethylene (PTFE), Fluorinated ethylene propylene (FEP), Perfluoroalkoxy alkanes (PFA), Polyvinylidene fluoride (PVDF), Ethylene tetrafluoroethylene (ETFE), Others)}

- Segmentation of Global High Performance Fluoropolymer Market By Application Capacity (Coatings & finishes, Electrical insulation, Equipment & components, Additives, Others)

- Segmentation of Global High Performance Fluoropolymer Market By End User (Chemical processing, Automotive & transportation, Electronics & electrical, Construction & architecture, Oil & gas, Water Treatment & desalination, Others)

- Statistical Snap of Global High Performance Fluoropolymer Market

- Expansion Analysis of Global High Performance Fluoropolymer Market

- Problems and Obstacles in Global High Performance Fluoropolymer Market

- Competitive Landscape in the Global High Performance Fluoropolymer Market

- Details on Current Investment in Global High Performance Fluoropolymer Market

- Competitive Analysis of Global High Performance Fluoropolymer Market

- Prominent Players in the Global High Performance Fluoropolymer Market

- SWOT Analysis of Global High Performance Fluoropolymer Market

- Global High Performance Fluoropolymer Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global High Performance Fluoropolymer Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global High Performance Fluoropolymer Market

7. Global High Performance Fluoropolymer Market, By Type, (USD Million) 2021-2034

7.1. Polytetrafluoroethylene (PTFE)

7.2. Fluorinated ethylene propylene (FEP)

7.3. Perfluoroalkoxy alkanes (PFA)

7.4. Polyvinylidene fluoride (PVDF)

7.5. Ethylene tetrafluoroethylene (ETFE)

7.6. Others

8. Global High Performance Fluoropolymer Market, By Application, (USD Million) 2021-2034

8.1. Coatings & finishes

8.2. Electrical insulation

8.3. Equipment & components

8.4. Additives

8.5. Others

9. Global High Performance Fluoropolymer Market, By End User, (USD Million) 2021-2034

9.1. Chemical processing

9.2. Automotive & transportation

9.3. Electronics & electrical

9.4. Construction & architecture

9.5. Oil & gas

9.6. Water Treatment & desalination

9.7. Others

10. Global High Performance Fluoropolymer Market, (USD Million) 2021-2034

10.1. Global High Performance Fluoropolymer Market Size and Market Share

11. Global High Performance Fluoropolymer Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. 3M Company

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. AGC Inc.

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Arkema Group

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Asahi Glass Co., Ltd. (AGC)

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Celanese Corporation

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Chemours Company

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Daikin Industries, Ltd.

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Dongyue Group Ltd.

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Gujarat Fluorochemicals Limited (GFL)

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Honeywell International Inc.

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Kuraray Co., Ltd.

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Saint-Gobain S.A

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.