High Temperature Industrial Boiler Market Introduction and Overview

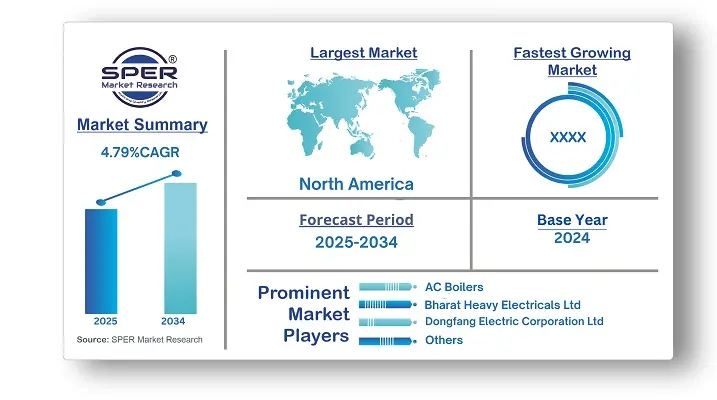

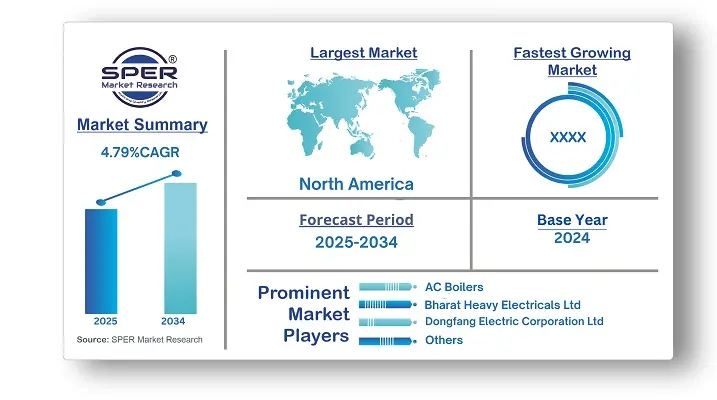

According to SPER Market Research, the Global High Temperature Industrial Boiler Market is estimated to reach USD 14.05 billion by 2034 with a CAGR of 4.79%.

The report includes an in-depth analysis of the Global High Temperature Industrial Boiler Market, including market size and trends, Interface mix, Applications, and supplier analysis. A high-temperature industrial boiler is a specialized heating system designed to generate steam or hot water at extreme temperatures for various industrial applications, including power generation, chemical processing, and manufacturing. These boilers operate at high pressures and temperatures to efficiently convert fuel sources such as coal, natural gas, biomass, or waste heat into thermal energy. The market for high-temperature industrial boilers is growing due to increasing industrialization, rising energy demand, and the shift toward efficient and sustainable heating solutions. However, challenges such as stringent environmental regulations, high operational costs, and the need for advanced maintenance and safety measures hinder market growth. Additionally, fuel price volatility and the transition to cleaner energy sources pose significant challenges for manufacturers and end users.

By Application Insights

With the biggest revenue share, the chemicals and petrochemicals application category led the industrial boiler market. Over the course of the projected period, the category is anticipated to maintain its dominance. Many different businesses utilize these tanks extensively for heating operations. In order to meet the needs, the technology has been continuously changing. These boilers are made to meet the EPA's emission regulations.

By Fuel Insights

The fossil fuel segment held the biggest market share revenue. These systems make extensive use of fossil fuels. Carbon monoxide is one of the many toxic gases produced by these fuels. Manufacturers of industrial boilers are driving the industry by continuously altering their products to satisfy national emission limits.

By Regional Insights

Asia Pacific dominated the market for industrial boilers and is also predicted to experience the quickest CAGR over the forecast period. The greatest population in the world resides in this region, and it is predicted to keep growing over the next several years. Energy supplies are being strained by the expanding population, and industrial boilers are thought to be a more effective and sustainable way to produce heat and steam than conventional techniques. The development of industrial boilers is also receiving assistance from the governments of Asia-Pacific nations.

Market Competitive Landscape

The market for High Temperature Industrial Boiler is very competitive. These companies focus on strategies like mergers and acquisitions, technological advancements, and expanding their product portfolios to maintain a competitive edge. Some of the prominent players in Global High Temperature Industrial Boiler Market are AC Boilers, Bharat Heavy Electricals Ltd., Cheema Boilers Limited, Dongfang Electric Corporation Ltd., Forbes Marshall, Harbin Electric Corporation, IHI Corporation, Mitsubishi Heavy Industries Ltd., Siemens AG, Thermax Ltd.

Recent Developments:

In March 2025: India announced plans to triple its fashion and textile industry value to $350 billion by 2030, including the development of seven industrial "mega-parks." This growth initiative emphasizes sustainability, with factories encouraged to adopt renewable energy sources like biomass boilers using agricultural waste.

In October 2024: Hepworth Brewery in West Sussex became the first UK brewery to utilize an ultra-high-temperature heat pump, replacing traditional oil boilers. This innovation generates steam at 130°C by recycling waste vapor from the brewing process, significantly reducing carbon emissions and cutting fuel costs by 40%.

In September 2024: A U.S. federal appeals court ruled against the Environmental Protection Agency's (EPA) 2022 regulation that retroactively tightened emissions standards for industrial boilers built before August 2020. The court found that the EPA misclassified these older boilers as "new sources" of hazardous air pollutants, thereby setting aside the rule for pre-August 2020 boilers.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Application, By Fuel |

| Regions covered | AC Boilers, Bharat Heavy Electricals Ltd., Cheema Boilers Limited, Dongfang Electric |

| Companies Covered | AC Boilers, Bharat Heavy Electricals Ltd., Cheema Boilers Limited, Dongfang Electric Corporation Ltd., Forbes Marshall, Harbin Electric Corporation, IHI Corporation, Mitsubishi Heavy Industries Ltd., Siemens AG, Thermax Ltd.

|

Key Topics Covered in the Report

- Global High Temperature Industrial Boiler Market Size (FY’2025-FY’2034)

- Overview of Global High Temperature Industrial Boiler Market

- Segmentation of Global High Temperature Industrial Boiler Market By Application (Chemicals & Petrochemicals, Paper & Pulp, Food & Beverages, Metals & Mining and Others)

- Segmentation of Global High Temperature Industrial Boiler Market By Fuel (Oil & Gas, Fossil, Non-fossil and Biomass)

- Statistical Snap of Global High Temperature Industrial Boiler Market

- Expansion Analysis of Global High Temperature Industrial Boiler Market

- Problems and Obstacles in Global High Temperature Industrial Boiler Market

- Competitive Landscape in the Global High Temperature Industrial Boiler Market

- Details on Current Investment in Global High Temperature Industrial Boiler Market

- Competitive Analysis of Global High Temperature Industrial Boiler Market

- Prominent Players in the Global High Temperature Industrial Boiler Market

- SWOT Analysis of Global High Temperature Industrial Boiler Market

- Global High Temperature Industrial Boiler Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global High Temperature Industrial Boiler Market Manufacturing Base Distribution, Sales Area, Interface Type

6.2. Mergers & Acquisitions, Partnerships, Interface Launch, and Collaboration in Global High Temperature Industrial Boiler Market

7. Global High Temperature Industrial Boiler Market, By Application 2021-2034 (USD Million)

7.1. Chemicals & Petrochemicals

7.2. Paper & Pulp

7.3. Food & Beverages

7.4. Metals & Mining

7.5. Others

8. Global High Temperature Industrial Boiler Market, By Fuel 2021-2034 (USD Million)

8.1. Oil & Gas

8.2. Fossil

8.3. Non-Fossil

8.4. Biomass

9. Global High Temperature Industrial Boiler Market Forecast, 2021-2034 (USD Million)

9.1. Global High Temperature Industrial Boiler Market Size and Market Share

10. Global High Temperature Industrial Boiler Market, By Region, 2021-2034 (USD Million)

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. AC Boilers

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Interface summary

11.1.4. Recent developments

11.2. Bharat Heavy Electricals Ltd.

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Interface summary

11.2.4. Recent developments

11.3. Cheema Boilers Limited

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Interface summary

11.3.4. Recent developments

11.4. Dongfang Electric Corporation Ltd.

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Interface summary

11.4.4. Recent developments

11.5. Forbes Marshall

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Interface summary

11.5.4. Recent developments

11.6. Harbin Electric Corporation

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Interface summary

11.6.4. Recent developments

11.7. IHI Corporation

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Interface summary

11.7.4. Recent developments

11.8. Mitsubishi Heavy Industries Ltd.

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Interface summary

11.8.4. Recent developments

11.9. Siemens AG

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Interface summary

11.9.4. Recent developments

11.10. Thermax Ltd.

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Interface summary

11.10.4. Recent developments

12. Conclusion

13. List of Abbreviations

14. Reference Links