Magnesium Chloride Market Introduction and Overview

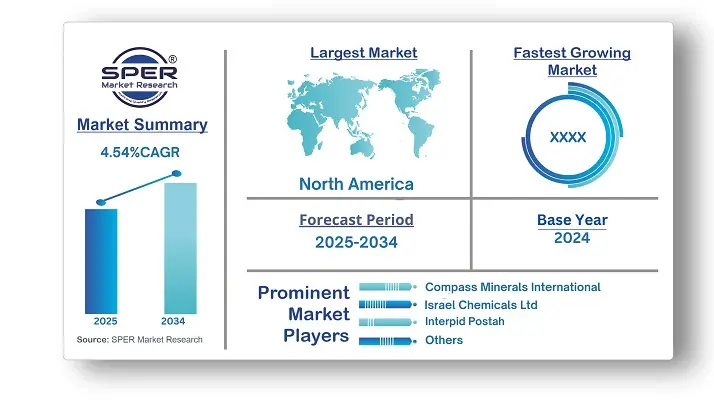

According to SPER Market Research, the Global Magnesium Chloride Market is estimated to reach USD 828.33 million by 2034 with a CAGR of 4.54%.

The report includes an in-depth analysis of the Global Magnesium Chloride Market, including market size and trends, product mix, Applications, and supplier analysis. The global magnesium chloride market size was estimated at USD 531.35 million in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 4.54% from 2025 to 2034. This growth is due to the widespread use of magnesium chloride in the cement industry. It acts as an additive that improves cement performance by enhancing workability, setting time, and early strength development, which speeds up construction. Additionally, it offers environmental benefits by reducing the carbon footprint of cement production by lowering clinker content, a major source of carbon dioxide emissions.

By Product Insights

The anhydrous magnesium chloride segment had the largest revenue share in 2024, mainly due to its use in industries like oil & gas, construction, and chemical manufacturing. The high demand for brine in the oil & gas sector and its role in various chemical processes boost the market. Magnesium chloride brine is used in drilling fluids to control viscosity and density, helping prevent blowouts and ensuring wellbore stability during operations.

Hexahydrate is commonly used as a de-icing agent during winter. When applied to roads, highways, and bridges, it helps melt ice and snow because it has a lower freezing point than water. This allows it to mix with moisture and form a brine solution, which prevents ice from forming and melts existing ice and snow. Using hexahydrate improves road conditions, enhances safety for drivers, and reduces the risk of skidding or sliding.

By End-User Insights

The construction segment had a large share in 2024 because the product is used in the construction industry as an additive in cement and concrete. It enhances the performance and durability of these materials. Demand in construction is increased by its ability to improve workability, setting time, early strength, and resistance to freeze-thaw cycles and chemical attacks. Additionally, it is used in the textile industry as a catalyst for making synthetic fibers like nylon and polyester and as a dye fixative to enhance color fastness.

Regional Insights

Asia Pacific led the global magnesium chloride market in 2024. The region is seeing strong market growth due to several reasons. First, rapid urbanization and infrastructure development in countries like China and India are increasing the need for magnesium chloride in construction, especially for fire-resistant materials and cement additives. Second, the growing automotive industry and harsh winter conditions drive demand for magnesium chloride as a deicing agent. Furthermore, the expanding industrial sector in Asia-Pacific boosts its use in metal production, wastewater treatment, and dust control.

Market Competitive Landscape

The magnesium chloride industry features several key players that drive its growth and competition. Companies like Compass Minerals International, Inc., Intrepid Potash, Inc., and Israel Chemical Ltd. play a major role, using their experience and varied products to meet the magnesium chloride needs of different industries. They provide various products, including industrial-grade options for deicing and dust suppression. Additionally, companies such as Merck KGaA and DEUSA international GmbH focus on high-quality pharmaceutical-grade magnesium chloride for strict quality requirements in pharmaceuticals and food applications, broadening the market's reach.

Recent Developments:

Cargill, a major private agricultural and chemical products company, plans to sell its de-icing salt operations in Lansing, NY, and Cleveland, Ohio, while advocating for environmentally friendly de-icing solutions such as pre-wet sodium chloride with liquid magnesium chloride and other additives.

In February 2022, Compass Minerals announced an expansion of magnesium chloride production at its facility near the Great Salt Lake in Utah. Compass Minerals is a top producer of salt and specialty mineral products.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By End-User |

| Regions covered | Compass Minerals International, Inc, K+S Aktiengesellschaft, Israel Chemicals Ltd, Shandong |

| Companies Covered | Compass Minerals International, Inc, K+S Aktiengesellschaft, Israel Chemicals Ltd, Shandong Haihua Group Co., Ltd, Huitai Investment Group Co., Ltd, Interpid Postah, Inc, Tianjin Changlu Haiging Group Co., Ltd, DEUSA international GmbH, Nedmag B.V, Nikomag OJSC.

|

Key Topics Covered in the Report

- Global Magnesium Chloride Market Size (FY’2021-FY’2034)

- Overview of Global Magnesium Chloride Market

- Segmentation of Global Magnesium Chloride Market By Product (Anhydrous Magnesium Chloride, Hexahydrate Magnesium Chloride)

- Segmentation of Global Magnesium Chloride Market By End-User (Textile, Wastewater Treatment Chemicals, Healthcare, Construction, Others)

- Statistical Snap of Global Magnesium Chloride Market

- Expansion Analysis of Global Magnesium Chloride Market

- Problems and Obstacles in Global Magnesium Chloride Market

- Competitive Landscape in the Global Magnesium Chloride Market

- Details on Current Investment in Global Magnesium Chloride Market

- Competitive Analysis of Global Magnesium Chloride Market

- Prominent Players in the Global Magnesium Chloride Market

- SWOT Analysis of Global Magnesium Chloride Market

- Global Magnesium Chloride Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Magnesium Chloride Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Magnesium Chloride Market

7. Global Magnesium Chloride Market, By Product (USD Million) 2021-2034

7.1. Anhydrous Magnesium Chloride

7.2. Hexahydrate Magnesium Chloride

8. Global Magnesium Chloride Market, By End-User (USD Million) 2021-2034

8.1. Textile

8.2. Wastewater Treatment Chemicals

8.3. Healthcare

8.4. Construction

8.5. Others

9. Global Magnesium Chloride Market, (USD Million) 2021-2034

9.1. Global Magnesium Chloride Market Size and Market Share

10. Global Magnesium Chloride Market, By Region, (USD Million) 2021-2034

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. Compass Minerals International, Inc

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. K+S Aktiengesellschaft

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Israel Chemicals Ltd

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Shandong Haihua Group Co, Ltd

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. Huitai Investment Group Co., Ltd

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

1.6. Interpid Postah, Inc

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Tianjin Changlu Haiging Group Co., Ltd

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. DEUSA International GmbH

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Nedmag B.V

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. Nikomag OJSC

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links