Modular & Prefabricated Construction Market Introduction and Overview

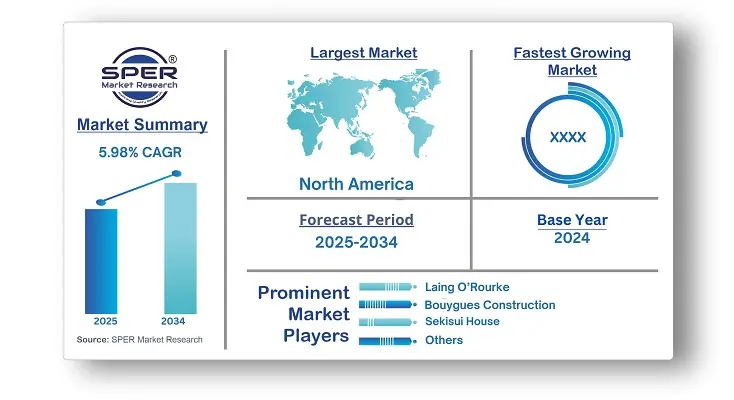

According to SPER Market Research, the Global Modular & Prefabricated Construction Market is estimated to reach USD 277.59 billion by 2034 with a CAGR of 5.98%

The report includes an in-depth analysis of the Global Modular & Prefabricated Construction Market, including market size and trends, product mix, Applications, and supplier analysis. The global construction industry is experiencing growth driven by rising demand for affordable housing and increased investment in healthcare and commercial infrastructure. Rapid urbanization and industrialization are fueling new projects, particularly in commercial and industrial sectors. Technological advancements in construction, combined with the benefits of modular building—such as faster timelines, lower costs, flexibility, and reduced waste—are boosting demand. However, the high costs associated with transporting modular structures pose a significant challenge. Modular construction is often located in rural areas to leverage cheaper labor, but transporting large modules over long distances is costly and further complicated by trucking regulations and weight limits.

By Product Type:

The permanent construction segment currently holds the leading position by product type and is expected to continue dominating the market in the foreseeable future. Permanent modular construction (PMC) is a forward-thinking and sustainable building method that involves the off-site fabrication of modules, which are later assembled into single or multi-story structures. These modules offer flexibility, as they can be integrated into existing buildings or constructed as standalone units, making PMC a versatile solution in modern construction practices.

By material:

By material, the steel segment plays a significant role in the modular construction market and is expected to see continued growth. Prefabricated steel buildings are constructed using pre-engineered components manufactured in a controlled factory environment, then transported to the construction site for assembly. These structures are known for their speed, affordability, and durability, with weather-resistant features due to precise factory production. Their clean, modern appearance makes them suitable for commercial and industrial applications. Additionally, the ability to easily deconstruct and reuse the structures at different locations adds to their appeal and is expected to drive ongoing demand.

By Regional Insights

The Europe region currently holds a leading position in the modular and prefabricated construction market and is anticipated to experience strong growth in the coming years. A major factor driving this expansion is the rising influx of migrants, which has created a growing need for both temporary and permanent housing solutions. In addition, increased investments and the adoption of advanced construction technologies are further supporting the growth of the modular construction sector across the region.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are Laing O’Rourke, Bouygues Construction, Larsen & Toubro Limited, Sekisui House, Ltd., VINCI Construction, Skanska, Lendlease Corporation, Kiewit Corporation, Hickory Group, Algeco (Modulaire Group), Red Sea International, Taisei Corporation, Others.

Recent Developments:

In September 2023, the city of Malmö in southern Sweden introduced a new student housing development, Unity Malmö, featuring five building blocks and 450 micro-living apartments. For this project, Forta PRO supplied 269 prefabricated modules, covering a total area of 9,671.9 square meters.

In February 2023, Modular Group Investments Ltd. (MGI) announced its acquisition of Oakland Glass Ltd., marking a key strategic step for the Group. This move significantly enhanced MGI’s capacity and expertise in the production of insulated double-glazed units. Additionally, the acquisition opened established market channels for Oakland Glass, aligning with both MGI's current activities and future growth plans.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Metal Type, By Solvent, By End Use |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Laing O’Rourke, Bouygues Construction, Larsen & Toubro Limited, Sekisui House, Ltd., VINCI Construction, Skanska, Lendlease Corporation, Kiewit Corporation, Hickory Group, Algeco (Modulaire Group), Red Sea International, Taisei Corporation, Others.

|

Key Topics Covered in the Report

- Global Modular & Prefabricated Construction Market Size (FY’2021-FY’2034)

- Overview of Global Modular & Prefabricated Construction Market

- Segmentation of Global Modular & Prefabricated Construction Market By Product type Type (Permanent, Relocatable)

- Segmentation of Global Modular & Prefabricated Construction Market By Material (Steel, Wood, Concrete, Others)

- Segmentation of Global Modular & Prefabricated Construction Market By Application Industry (Single family residential, Multi-family residential, Offices, Hospitality, Retail, Healthcare, Others)

- Statistical Snap of Global Modular & Prefabricated Construction Market

- Expansion Analysis of Global Modular & Prefabricated Construction Market

- Problems and Obstacles in Global Modular & Prefabricated Construction Market

- Competitive Landscape in the Global Modular & Prefabricated Construction Market

- Details on Current Investment in Global Modular & Prefabricated Construction Market

- Competitive Analysis of Global Modular & Prefabricated Construction Market

- Prominent Players in the Global Modular & Prefabricated Construction Market

- SWOT Analysis of Global Modular & Prefabricated Construction Market

- Global Modular & Prefabricated Construction Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Modular & Prefabricated Construction Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Modular & Prefabricated Construction Market

7. Global Modular & Prefabricated Construction Market, By Product type, (USD Million) 2021-2034

7.1. Permanent

7.2. Relocatable

8. Global Modular & Prefabricated Construction Market, By Material, (USD Million) 2021-2034

8.1. Steel

8.2. Wood

8.3. Concrete

8.4. Others (aluminum, polyurethane & glass fiber)

9. Global Modular & Prefabricated Construction Market, By Application, (USD Million) 2021-2034

9.1. Single family residential

9.2. Multi-family residential

9.3. Offices

9.4. Hospitality

9.5. Retail

9.6. Healthcare

9.7. Others (educational buildings, data centers, etc.)

10. Global Modular & Prefabricated Construction Market, (USD Million) 2021-2034

10.1. Global Modular & Prefabricated Construction Market Size and Market Share

11. Global Modular & Prefabricated Construction Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Laing O’Rourke

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Bouygues Construction

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Larsen & Toubro Limited

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Sekisui House, Ltd.

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. VINCI Construction

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Skanska

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Lendlease Corporation

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Kiewit Corporation

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Hickory Group

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Algeco (Modulaire Group)

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Red Sea International

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Taisei Corporation

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links