Nitrogen Gas Market Introduction and Overview

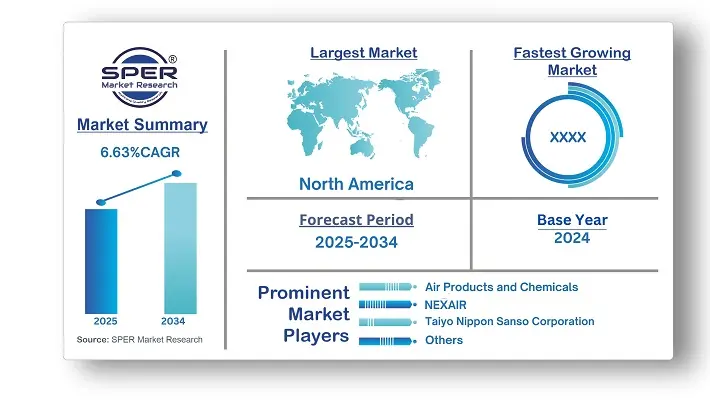

According to SPER Market Research, the Global Nitrogen Gas Market is estimated to reach USD 58.35 billion by 2034 with a CAGR of 6.63%.

The report includes an in-depth analysis of the Global Nitrogen Gas Market, including market size and trends, product mix, Applications, and supplier analysis. The global nitrogen gas market is expected to be worth USD 30.71 billion in 2024, with a CAGR of 6.63% between 2025 and 2034. This is due to ongoing urbanisation and industrialisation, as well as increased use of nitrogen in industries such as healthcare, manufacturing, metals and mining, and food and beverage. Furthermore, increased production of packaged foods, medications and pharmaceuticals, and electronic devices is expected to be a significant development driver.

By Form Insights

The liquid nitrogen gas segment held the largest revenue share in the market in 2024. It is derived from liquid air through fractional distillation and is used in cooling and cryogenic processes. Liquid nitrogen is non-toxic, odorless, colorless, chemically inert, and non-flammable, making it popular in the chemical and pharmaceutical industries. It aids in safely transferring reaction mixtures during pharmaceutical manufacturing, as using an inert gas is essential to prevent hazards from exposure to oxygen or water vapor, which can affect certain chemicals.

By Application Insights

In 2024, the food and beverage sector had the most revenue share because nitrogen was being used more and more in a variety of applications. This gas is mainly used for preservation in food packaging, creating a nitrogen-rich environment that stops spoilage-causing microorganisms. It is also used in packaging perishable food to keep it fresh and extend its shelf life.

Additionally, nitrogen is used in pharmaceuticals to create an inert atmosphere during medicine production and to protect medications from moisture and degradation. This is expected to boost nitrogen demand and market growth in the future.

Regional Insights

The North America nitrogen gas market had a large share in 2024 due to rising demand from industries like pharmaceuticals, food and beverage, oil and gas, and petrochemicals. These sectors use nitrogen gas for preservation, packaging, and manufacturing, aiding market growth. The Asia Pacific nitrogen gas market is expected to grow rapidly. Countries like China, India, and Southeast Asia are seeing industrial growth, with government support boosting the semiconductor industry and driving nitrogen gas demand.

Market Competitive Landscape

The global nitrogen gas industry has major players, including Linde plc, Air Products and Chemicals, Inc., Taiyo Nippon Sanso Corporation, and Praxair Technology, Inc. These companies compete fiercely with each other and local firms that have strong distribution networks and knowledge of suppliers and regulations. Linde Plc, established in 2018 and based in Surrey, UK, produces various gases and serves multiple markets like chemicals, healthcare, and manufacturing with 45 subsidiaries worldwide.

Recent Developments:

In 2024, Air Liquide plans to invest over 50 million euros to create a new facility in Singapore and upgrade its existing infrastructure in Malta, New York, USA. The goal is to provide GlobalFoundries (GF) with high-purity nitrogen and improve energy efficiencies.

Air Water America, the United States subsidiary of Japan-based Air Water Inc., announced plans in August 2023 to build the first air separation unit in Rochester, New York. As a result, the former expects to succeed in both production and industrial gas sales.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Form, By Application |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Air Products and Chemicals, Inc, Gulfcryo, Universal Industrial Gases, Inc, NEXAIR, Southern Industrial Gas Sdn Bhd, Praxair Technology, Inc, Taiyo Nippon Sanso Corporation, Axcel Gases, Linde Plc, Omega Air, Ellenbarrie Industrial Gases, Messer Group. |

Key Topics Covered in the Report

- Global Nitrogen Gas Market Size (FY’2021-FY’2034)

- Overview of Global Nitrogen Gas Market

- Segmentation of Global Nitrogen Gas Market By Form (Compressed Gas, Liquid Nitrogen Gas)

- Segmentation of Global Nitrogen Gas Market By Application (Food & Beverages, Chemicals, Pharmaceuticals, Electronics, Others)

- Statistical Snap of Global Nitrogen Gas Market

- Expansion Analysis of Global Nitrogen Gas Market

- Problems and Obstacles in Global Nitrogen Gas Market

- Competitive Landscape in the Global Nitrogen Gas Market

- Details on Current Investment in Global Nitrogen Gas Market

- Competitive Analysis of Global Nitrogen Gas Market

- Prominent Players in the Global Nitrogen Gas Market

- SWOT Analysis of Global Nitrogen Gas Market

- Global Nitrogen Gas Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Nitrogen Gas Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Nitrogen Gas Market

7. Global Nitrogen Gas Market, By Form (USD Million) 2021-2034

7.1. Compressed Gas

7.2. Liquid Nitrogen Gas

8. Global Nitrogen Gas Market, By Application (USD Million) 2021-2034

8.1. Food & Beverage

8.2. Chemicals

8.3. Pharmaceuticals

8.4. Electronics

8.5. Others

9. Global Nitrogen Gas Market, (USD Million) 2021-2034

9.1. Global Nitrogen Gas Market Size and Market Share

10. Global Nitrogen Gas Market, By Region, (USD Million) 2021-2034

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. Air Products and Chemicals, Inc

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. Gulfcryo

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Universal Industrial Gases, Inc

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. NEXAIR

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. Southern Industrial Gas Sdn Bhd

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Praxair Technology, Inc

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Taiyo Nippon Sanso Corporation

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Axcel Gases

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Linde Plc

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. Omega Air

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. Ellenbarrie Industrial Gases

11.11.1. Company details

11.11.2. Financial outlook

11.11.3. Product summary

11.11.4. Recent developments

11.12. Messer Group

11.12.1. Company details

11.12.2. Financial outlook

11.12.3. Product summary

11.12.4. Recent developments

11.13. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links