Plastic Adhesives Market Introduction and Overview

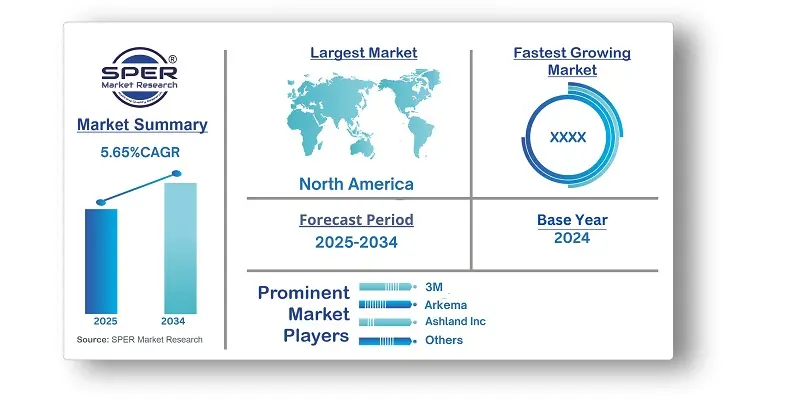

According to SPER Market Research, the Global Plastic Adhesives Market is estimated to reach USD 14.81 billion by 2034 with a CAGR of 5.65%

The report includes an in-depth analysis of the Global Plastic Adhesives Market, including market size and trends, product mix, Applications, and supplier analysis. "The need for plastic adhesives is expanding, fueled by key sectors like packaging, construction, and transportation, all demanding strong and adaptable bonding. In vehicle manufacturing, the move towards lighter materials and efficient assembly is a significant driver. Consumer goods also rely heavily on these adhesives for both functional and aesthetic purposes. However, growing environmental concerns, particularly regarding pollution and disposal, are creating challenges. Stricter regulations on VOCs and hazardous materials are pushing manufacturers to develop more environmentally friendly and compliant adhesives, essential for navigating regulatory hurdles and ensuring continued market growth."

By Resin Type:

"Plastic adhesives are classified by resin type, including epoxy, acrylic, silicone, polyurethane (PU), cyanoacrylate, and others. Epoxy resins hold the largest market share due to their superior bonding strength and adaptability. They effectively join diverse materials like plastics, metals, and composites, making them suitable for numerous applications."

By Substrate:

The plastic adhesives market is categorized by substrate type, including polyethylene (PE), polypropylene (PP), PVC, and others. Polyethylene is highly popular in the market due to its widespread use across various industries and applications.

By End Use:

"Plastic adhesive usage varies across sectors, including packaging, construction, transportation, medical devices, and consumer goods. Packaging is the largest end-use market, driven by its demand for reliable bonding across diverse materials. Plastic adhesives are crucial for secure seals, lamination, and assembly in films, foils, and containers."

By Regional Insights

Asia Pacific led the global plastic adhesives market in 2024, driven by rapid industrialization and urbanization in countries like China, India, and Southeast Asian nations. This growth spurred demand for plastic adhesives in key sectors such as construction, automotive, and consumer goods. The region’s expanding manufacturing sector also contributed to the increased need for adhesives in assembly and production processes. Additionally, the growth of the packaging industry, fueled by e-commerce and the fast-moving consumer goods (FMCG) sector, further boosted the demand for plastic adhesives in packaging applications. Government initiatives supporting infrastructure development and investments in manufacturing continue to stimulate market growth in the region.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are H.B. Fuller, Henkel AG, Illinois Tool Works, Mapei S.P.A., Master Bond Inc, 3M, Arkema, Ashland Inc, Dow Inc, Dymax Corporation and others.

Recent Developments:

"In April 2023, Dow and Avery Dennison launched an innovative, sustainable hotmelt label adhesive. This product enables the combined mechanical recycling of polyolefin film labels with polypropylene (PP) or polyethylene (PE) packaging, streamlining the recycling process. Notably, it's the first label adhesive to achieve Recyclass approval for recycling within the HDPE colored stream - Class B."

"Arkema announced its intent to purchase Polimeros Especiales, a Mexican supplier of waterborne acrylic resins, in July 2022."The company stated that this acquisition would enhance its presence in the rapidly growing region.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Resin Type, By Substrate, By End Use |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | 3M, Arkema, Ashland Inc, Dow Inc, Dymax Corporation, H.B. Fuller, Henkel AG, Illinois Tool Works, Mapei S.P.A., Master Bond Inc, and others. |

Key Topics Covered in the Report

- Global Plastic Adhesives Market Size (FY’2021-FY’2034)

- Overview of Global Plastic Adhesives Market

- Segmentation of Global Plastic Adhesives Market By Resin Type (Epoxy, Acrylic, Silicone, Polyurethane (PU), Cyanoacrylate, Others)

- Segmentation of Global Plastic Adhesives Market By Substrate {(Polyethylene (PE), Polypropylene (PP), PVC, Other)}

- Segmentation of Global Plastic Adhesives Market By End Use (Packaging, Building & Construction, Transportation, Medical Devices, Consumer Goods, Other)

- Statistical Snap of Global Plastic Adhesives Market

- Expansion Analysis of Global Plastic Adhesives Market

- Problems and Obstacles in Global Plastic Adhesives Market

- Competitive Landscape in the Global Plastic Adhesives Market

- Details on Current Investment in Global Plastic Adhesives Market

- Competitive Analysis of Global Plastic Adhesives Market

- Prominent Players in the Global Plastic Adhesives Market

- SWOT Analysis of Global Plastic Adhesives Market

- Global Plastic Adhesives Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Plastic Adhesives Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Plastic Adhesives Market

7. Global Plastic Adhesives Market, By Resin Type, (USD Million) 2021-2034

7.1. Epoxy

7.2. Acrylic

7.3. Silicone

7.4. Polyurethane (PU)

7.5. Cyanoacrylate

7.6. Others

7.7.

8. Global Plastic Adhesives Market, By Substrate, (USD Million) 2021-2034

8.1. Polyethylene (PE)

8.2. Polypropylene (PP)

8.3. PVC

8.4. Other

9. Global Plastic Adhesives Market, By End Use, (USD Million) 2021-2034

9.1. Packaging

9.2. Building & Construction

9.3. Transportation

9.4. Medical Devices

9.5. Consumer Goods

9.6. Other

10. Global Plastic Adhesives Market, (USD Million) 2021-2034

10.1. Global Plastic Adhesives Market Size and Market Share

11. Global Plastic Adhesives Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. 3M

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Arkema

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Ashland Inc

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Dow Inc

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Dymax Corporation

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. H.B. Fuller

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Henkel AG

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Illinois Tool Works

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Mapei S.P.A.

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Master Bond Inc

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.