Refinery Process Chemicals Market Introduction and Overview

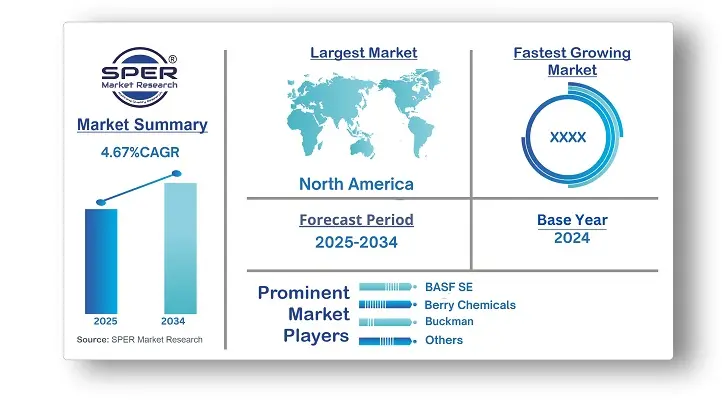

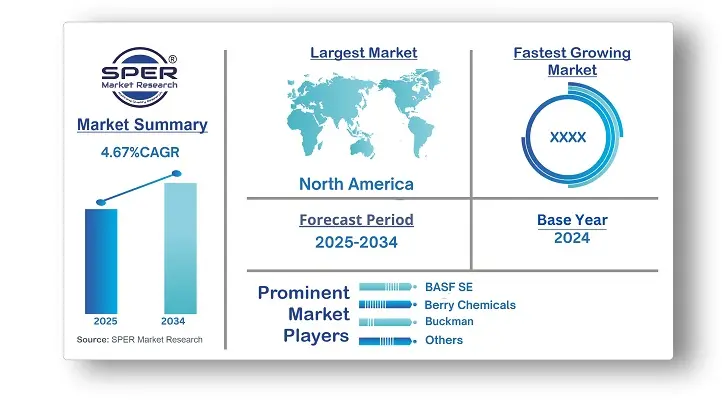

According to SPER Market Research, the Global Refinery Process Chemicals Market is estimated to reach USD 7.93 billion by 2034 with a CAGR of 4.67%.

The report includes an in-depth analysis of the Global Refinery Process Chemicals Market, including market size and trends, product mix, Applications, and supplier analysis. The refinery process chemicals industry is witnessing steady growth, driven by increasing demand for high-performance additives that enhance efficiency and reduce emissions. Stricter environmental regulations and the push for cleaner fuels are encouraging refineries to adopt advanced chemicals to optimize operations, lower energy use, and reduce pollutants like sulfur and nitrogen oxides. Rising investments in refinery modernization and expansion projects, especially in emerging economies, further propel market growth. Additionally, the need to meet stringent fuel quality standards is boosting the use of specialized additives. These factors collectively support the industry's shift toward sustainability, innovation, and improved refining performance. However, High initial investment costs, including R&D, equipment, and customization, pose a major barrier to adopting advanced refinery process chemicals, particularly for smaller players. Economic uncertainties and volatile oil prices further hinder investments, emphasizing the need for strategic partnerships and efficient resource use to drive market growth.

By Type:

The market is categorized based on type into catalysts, pH adjusters, anti-fouling agents, corrosion inhibitors, and demulsifiers. Catalysts are witnessing a strong trend toward innovation and customization, with refineries increasingly adopting specialized solutions to enhance processes like hydrocracking, catalytic cracking, and hydrotreating. There is a rising focus on developing catalysts with improved selectivity, activity, and stability to boost yields, lower energy consumption, and comply with strict product quality standards.

By Application:

Based on application, the market is segmented into crude oil distillation, hydrotreating, catalytic cracking, alkylation, and isomerization. Crude oil distillation is experiencing a shift toward greater efficiency and sustainability in the refinery process chemicals market. Refineries are increasingly adopting advanced chemical additives to enhance distillation performance, aiming to maximize yields of high-value products like gasoline, diesel, and jet fuel while reducing energy use and emissions. There is rising demand for specialized distillation aids such as antifoam agents, corrosion inhibitors, and heat transfer enhancers, which support improved operations and help meet strict environmental regulations, fueling innovation in this segment.

By End User:

The market is divided by end-use into petroleum refineries, petrochemical plants, chemical processing facilities, oil and gas exploration companies, and other sectors. In the petroleum refineries segment, a strong shift toward digitalization and automation is reshaping the refinery process chemicals industry. Refineries are adopting advanced chemical solutions integrated with digital tools for real-time process monitoring and optimization. This move aims to boost operational efficiency, reduce downtime, and maintain consistent product quality.

By Regional Insights

Asia Pacific led the global refinery process chemicals market, driven by a strong focus on innovation and sustainability. Refineries across the region are increasingly investing in advanced chemical solutions to boost efficiency, lower emissions, and comply with strict regulatory standards. There is rising demand for environmentally friendly additives and catalysts that help reduce environmental impact while optimizing refining operations. Furthermore, the integration of digital technologies and data analytics into chemical management systems is enhancing operational performance and ensuring regulatory compliance, further accelerating market growth in the region.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are BASF SE, Berry Chemicals, Buckman, Cestoil, Chemiphase, Chevron Phillips Chemical Company LLC, Clariant AG, Dow, Exxon Mobil, Lubrizol, Others.

Recent Developments:

In 2023, India’s leading oil and gas producer ONGC announced plans to invest approximately INR 1 lakh crore in establishing two petrochemical plants aimed at converting crude oil directly into high-value chemical products, as part of its strategy to support the energy transition.

In September 2023, ExxonMobil announced the launch of two new chemical production units at its Baytown facility in Texas. This USD 2 billion expansion is part of the company’s broader strategy to generate higher-value products from its refining and chemical operations along the U.S. Gulf Coast.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Application, By End Use - |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | BASF SE, Berry Chemicals, Buckman, Cestoil, Chemiphase, Chevron Phillips Chemical Company LLC, Clariant AG, Dow, Exxon Mobil, Lubrizol, Others.

|

Key Topics Covered in the Report

- Global Refinery Process Chemicals Market Size (FY’2021-FY’2034)

- Overview of Global Refinery Process Chemicals Market

- Segmentation of Global Refinery Process Chemicals Market By Type (Catalyst, PH Adjustors, Anti-fouling Agents, Corrosion Inhibitors, Demulsifiers)

- Segmentation of Global Refinery Process Chemicals Market By Application (Crude Oil Distillation, Hydrotreating, Catalytic Cracking, Alkylation, Isomerization)

- Segmentation of Global Refinery Process Chemicals Market By End-use (Petroleum Refineries, Petrochemical Plants, Chemical Processing Facilities, Oil & Gas Exploration Companies, Others)

- Statistical Snap of Global Refinery Process Chemicals Market

- Expansion Analysis of Global Refinery Process Chemicals Market

- Problems and Obstacles in Global Refinery Process Chemicals Market

- Competitive Landscape in the Global Refinery Process Chemicals Market

- Details on Current Investment in Global Refinery Process Chemicals Market

- Competitive Analysis of Global Refinery Process Chemicals Market

- Prominent Players in the Global Refinery Process Chemicals Market

- SWOT Analysis of Global Refinery Process Chemicals Market

- Global Refinery Process Chemicals Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Refinery Process Chemicals Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Refinery Process Chemicals Market

7. Global Refinery Process Chemicals Market, By Type, (USD Million) 2021-2034

7.1. Catalyst

7.2. PH Adjustors

7.3. Anti-fouling Agents

7.4. Corrosion Inhibitors

7.5. Demulsifiers

8. Global Refinery Process Chemicals Market, By Application, (USD Million) 2021-2034

8.1. Crude Oil Distillation

8.2. Hydrotreating

8.3. Catalytic Cracking

8.4. Alkylation

8.5. Isomerization

9. Global Refinery Process Chemicals Market, By End-use, (USD Million) 2021-2034

9.1. Petroleum Refineries

9.2. Petrochemical Plants

9.3. Chemical Processing Facilities

9.4. Oil & Gas Exploration Companies

9.5. Others

10. Global Refinery Process Chemicals Market, (USD Million) 2021-2034

10.1. Global Refinery Process Chemicals Market Size and Market Share

11. Global Refinery Process Chemicals Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. BASF SE

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Berry Chemicals

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Buckman

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Cestoil

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Chemiphase

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Chevron Phillips Chemical Company LLC

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Clariant AG

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Dow

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Exxon Mobil

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Lubrizol

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.