Global Silicone Additives Market Introduction and Overview

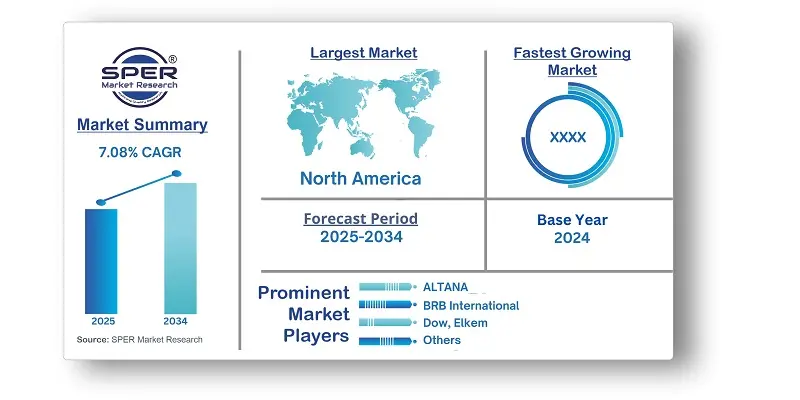

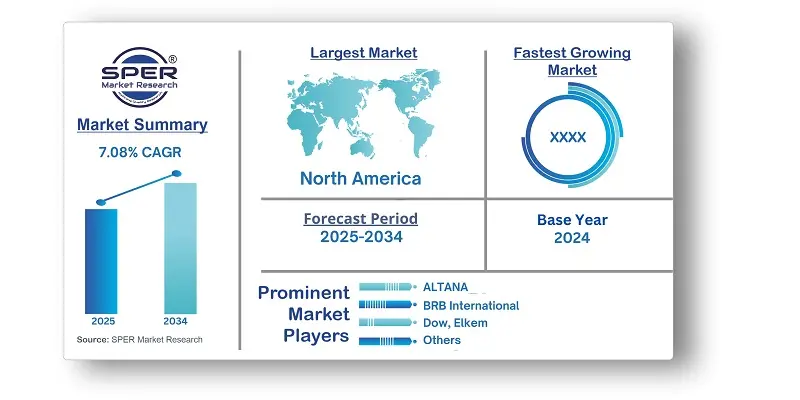

According to SPER Market Research, the Global Silicone Additives Market is estimated to reach USD 3.8 billion by 2034 with a CAGR of 7.08%.

The report includes an in-depth analysis of the Global Silicone Additives Market, including market size and trends, product mix, Applications, and supplier analysis. The silicone additives market is experiencing consistent expansion, propelled by growing requirements from the automotive, construction, and personal care industries. Their exceptional attributes, including thermal stability, water repellence, UV resistance, and high lubricity, render them ideal for utilization in plastics, coatings, inks, and composites. Silicone masterbatches enhance the processing of polyolefins and prevent surface exudation that attracts dust. These additives improve surface quality, resistance to marring, and control of foam, making them valuable for electronics, appliances, and medical devices. Ongoing advancements in formulation methods aimed at enhancing performance and sustainability are anticipated to further stimulate demand throughout the forecast period. Nevertheless, elevated production expenses and stringent environmental regulations may impede the broader adoption of silicone additives across diverse industries. Furthermore, their susceptibility to moisture and powdery form complicate handling and storage, potentially impacting their effectiveness.

By Type:

Classified by type, the market is divided into silicone surfactants, emulsifiers, resins, fluids, polymers, and other categories. Silicone surfactants are demonstrating robust global growth due to their adaptable characteristics and extensive applications across numerous industries. This growth is further supported by increasing demand for environmentally friendly, multi-functional surfactants, influenced by regulatory demands and rising consumer interest in sustainable products.

By Function:

Categorized by function, the market is segmented into lubrication, wetting and dispersing agents, surfactants, defoamers, and other categories. Recognized for their outstanding lubricating qualities, silicone additives are widely employed in industries such as automotive, aerospace, and manufacturing. This demand is driven by the necessity to enhance performance, minimize friction, and prolong the lifespan of mechanical components. Continuous progress in silicone technology has also facilitated the development of specialized lubricants tailored for specific applications, further bolstering market expansion.

By End User:

Based on end-use, the market is categorized into paints and coatings, paper and pulp, personal care, food and beverages, oil and gas, and other sectors. A key trend in the silicone additives market is the growing incorporation of silicone-based additives in paint and coating formulations. These additives improve resistance to weather, durability, and adhesion to various substrates, rendering them highly suitable for architectural, automotive, and industrial uses. The demand is largely driven by the necessity for high-performance coatings capable of withstanding harsh environmental conditions while providing long-term protection.

By Regional Insights:

Asia Pacific currently holds the largest portion of the global silicone additives market and is projected to maintain strong growth in the coming years. This growth is fueled by the rapid expansion of key industries such as construction, automotive, and personal care. Factors like urbanization, infrastructure development, and increasing disposable incomes are driving the demand for silicone additives in applications like paints, coatings, adhesives, sealants, and cosmetics. The region also benefits from a strong manufacturing base and increased investment in research and development, fostering innovation in product formulations.

Market Competitive Landscape:

The market demonstrates a moderately consolidated competitive environment. Some of the key participants in the market include ALTANA, BRB International, Dow, Elkem, Evonik, Momentive Performance Materials, Shin-Etsu, Siltech, and Wacker Chemie.

Recent Developments:

Elkem (Jan 2024): Launched a new iron-silicon powder for 3D-printed electric motor parts with improved magnetic properties through the EU's SOMA project, collaborating with VTT, Stellantis, Siemens, and Gemmate Technologies.

BRB International (Nov 2021): Rebranded to show its connection with PETRONAS Chemicals Group (PCG) but will still operate independently and focus on innovation to meet customer and industry demands.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By

Formulation, By End Use |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East

& Africa |

| Companies Covered | ALTANA,

BRB International, Dow, Elkem, Evonik, Momentive Performance Materials, Shin-Etsu,

Siltech, and Wacker Chemie. |

Key Topics Covered in the Report

- Global Silicone Additives Market Size (FY’2021-FY’2034)

- Overview of Global Silicone Additives Market

- Segmentation of Global Silicone Additives Market By Type (Silicone Surfactants, Silicone Emulsifiers, Silicone Resins, Silicone Fluids, Silicone Polymers, Others)

- Segmentation of Global Silicone Additives Market By Function (Lubrication, Wetting & Dispersing Agent, Surfactants, Deformers, Others)

- Segmentation of Global Silicone Additives Market By End-use (Paints & Coatings, Paper & Pulp, Personal Care, Food & Beverages, Oil & Gas, Others)

- Statistical Snap of Global Silicone Additives Market

- Expansion Analysis of Global Silicone Additives Market

- Problems and Obstacles in Global Silicone Additives Market

- Competitive Landscape in the Global Silicone Additives Market

- Details on Current Investment in Global Silicone Additives Market

- Competitive Analysis of Global Silicone Additives Market

- Prominent Players in the Global Silicone Additives Market

- SWOT Analysis of Global Silicone Additives Market

- Global Silicone Additives Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Silicone Additives Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Silicone Additives Market

7. Global Silicone Additives Market, By Type, (USD Million) 2021-2034

7.1. Silicone Surfactants

7.2. Silicone Emulsifiers

7.3. Silicone Resins

7.4. Silicone Fluids

7.5. Silicone Polymers

7.6. Others

8. Global Silicone Additives Market, By Function, (USD Million) 2021-2034

8.1. Lubrication

8.2. Wetting & Dispersing Agent

8.3. Surfactants

8.4. Deformers

8.5. Others

9. Global Silicone Additives Market, By End-use, (USD Million) 2021-2034

9.1. Paints & Coatings

9.2. Paper & Pulp

9.3. Personal Care

9.4. Food & Beverages

9.5. Oil & Gas

9.6. Others

10. Global Silicone Additives Market, (USD Million) 2021-2034

10.1. Global Silicone Additives Market Size and Market Share

11. Global Silicone Additives Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. ALTANA

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. BRB International

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Dow

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Elkem

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Evonik

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Momentive Performance Materials

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Shin-Etsu

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Siltech

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Wacker Chemie

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.