Tantalum Pentoxide Market Introduction and Overview

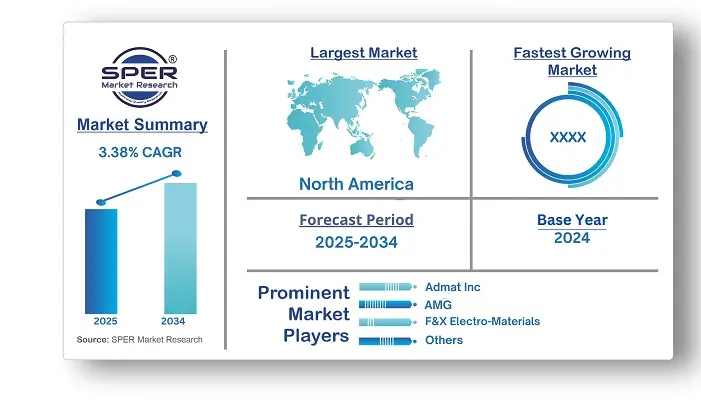

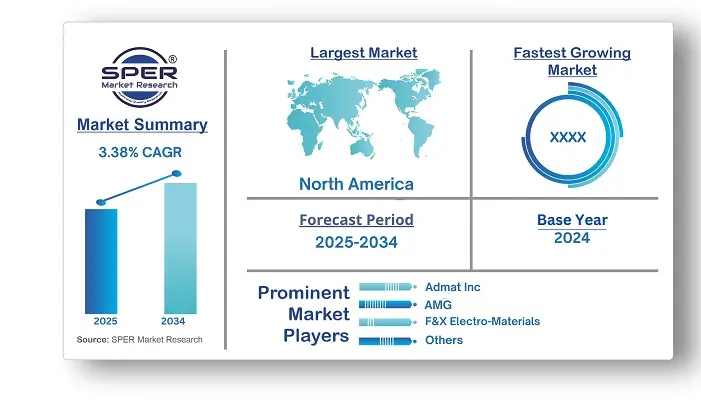

According to SPER Market Research, the Global Tantalum Pentoxide Market is estimated to reach USD 632.8 million by 2034 with a CAGR of 3.38%.

The report includes an in-depth analysis of the Global Tantalum Pentoxide Market, including market size and trends, product mix, Applications, and supplier analysis. As the global electronics industry continues to grow, especially in developing markets, the demand for tantalum pentoxide is expected to increase steadily. Its expanding use in areas like optoelectronics, semiconductors, and chemical processing further supports this upward trend. The push for smaller, more efficient electronic components also boosts the need for tantalum pentoxide due to its excellent dielectric properties and stability. Additionally, rising investments in renewable energy technologies—including solar and wind power—are enhancing its role in energy storage solutions. Together, these factors are poised to significantly elevate the market's value over the coming years. However, The tantalum pentoxide market faces risks from supply chain disruptions, especially due to ethical concerns around sourcing from conflict regions. Fluctuating demand, regulatory shifts, and mining challenges may also cause instability and price volatility.

By Product:

The market, based on product type, is categorized into Ta2O5 ≥99.9%, Ta2O5 99.9–99.99%, and Ta2O5 ≥99.99%. Among these segments, Ta2O5 ≥99.9% accounts for the largest share. This grade of tantalum pentoxide is widely favored for its cost-effectiveness, particularly in industries like construction, ceramics, and basic electronics, where ultra-high purity is not critical. Its broad availability and lower production costs make it an attractive option for manufacturers aiming to balance performance with affordability. Additionally, for various industrial and non-electronic applications, the slightly lower purity of this grade meets requirements efficiently, making it a practical choice across multiple sectors.

By Application:

Based on application, the market is segmented into electronic applications, lithium tantalate single crystals, sputtering targets, and others. Among these, electronic applications lead the market due to the widespread use of tantalum capacitors in modern electronic devices. Tantalum pentoxide is essential in capacitor production thanks to its high dielectric constant and excellent stability, making it a key material in consumer electronics, telecommunications, and industrial equipment. Ongoing advancements in electronic technology continue to drive demand in this segment, while the growing focus on device miniaturization further reinforces the importance of tantalum pentoxide in creating compact, high-performance components.

By Regional Insights

Asia Pacific emerged as the leading region in the global Tantalum Pentoxide Market in 2024, driven by rapid industrialization and urbanization in countries such as China, India, and those in Southeast Asia. This growth fuels demand for nanoclays across a range of industries, including automotive, construction, packaging, and electronics. Additionally, the rising adoption of advanced materials and technologies in emerging economies is boosting the use of nanoclays to enhance product performance and sustainability. Government support and increased investments in research and development are also playing a key role, encouraging innovation and the advancement of nanoclay-based technologies in the region.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are Admat Inc, AMG, F&X Electro-Materials, Jiujiang Tanbre, KING-TAN Tantalum, Lorad Chemical Corporation, Laviosa Corporate, Materion, Mitsui Kinzoku, and others.

Recent Developments:

July 2020: H.C. Starck Tantalum & Niobium rebranded itself as Taniobis. The company will still offer a wide range of tantalum and niobium-based materials, powders, and alloys under its new name.

April 2024: Premier African Minerals obtained USD 2.12 million in funding. This money will be used to finish setting up the Zulu project, specifically for operational costs and to fine-tune the flotation plant's material processing at their Zulu lithium and tantalum project in Zimbabwe, which is currently being commissioned.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Application |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Admat Inc, AMG, F&X Electro-Materials, Jiujiang Tanbre, KING-TAN Tantalum, Lorad Chemical Corporation, Laviosa Corporate, Materion, and Mitsui Kinzoku.

|

Key Topics Covered in the Report

- Global Tantalum Pentoxide Market Size (FY’2021-FY’2034)

- Overview of Global Tantalum Pentoxide Market

- Segmentation of Global Tantalum Pentoxide Market By Product (Ta2O5 99.9%, Ta2O5: 99.9-99.99%, Ta2O5 > 99.99%)

- Segmentation of Global Tantalum Pentoxide Market By Application (Electronic applications, Lithium tantalate single crystals, Sputtering targets, Others)

- Statistical Snap of Global Tantalum Pentoxide Market

- Expansion Analysis of Global Tantalum Pentoxide Market

- Problems and Obstacles in Global Tantalum Pentoxide Market

- Competitive Landscape in the Global Tantalum Pentoxide Market

- Details on Current Investment in Global Tantalum Pentoxide Market

- Competitive Analysis of Global Tantalum Pentoxide Market

- Prominent Players in the Global Tantalum Pentoxide Market

- SWOT Analysis of Global Tantalum Pentoxide Market

- Global Tantalum Pentoxide Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Tantalum Pentoxide Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Tantalum Pentoxide Market

7. Global Tantalum Pentoxide Market, By Product, (USD Million) 2021-2034

7.1. Ta2O5 99.9%

7.2. Ta2O5: 99.9-99.99%

7.3. Ta2O5 > 99.99%

8. Global Tantalum Pentoxide Market, By Application, (USD Million) 2021-2034

8.1. Electronic applications

8.2. Lithium tantalate single crystals

8.3. Sputtering targets

8.4. Others

9. Global Tantalum Pentoxide Market, (USD Million) 2021-2034

9.1. Global Tantalum Pentoxide Market Size and Market Share

10. Global Tantalum Pentoxide Market, By Region, 2021-2034 (USD Million)

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. Admat Inc

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. AMG

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. F&X Electro-Materials

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Jiujiang Tanbre

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. KING-TAN Tantalum

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Lorad Chemical Corporation

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Laviosa corporate

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Materion

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Mitsui Kinzoku

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.