Timber Laminating Adhesives Market Introduction and Overview

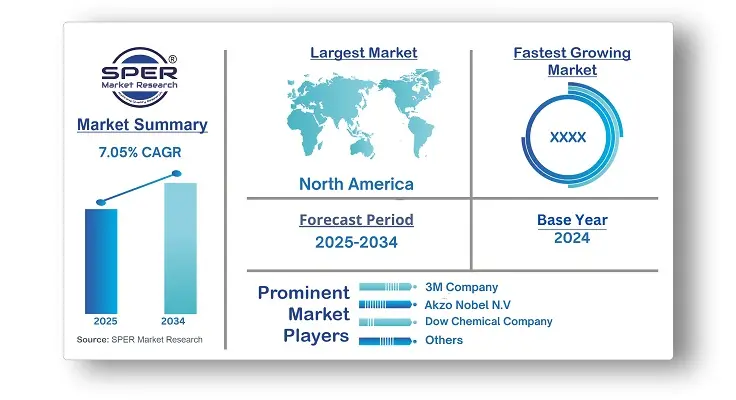

According to SPER Market Research, the Global Timber Laminating Adhesives Market is estimated to reach USD 2024.72 million by 2034 with a CAGR of 7.05%.

The report includes an in-depth analysis of the Global Timber Laminating Adhesives Market, including market size and trends, product mix, Applications, and supplier analysis. The Timber Laminating Adhesives Market was valued at around USD 1024.47 million in 2024 and is expected to grow at a rate of over 7.05% from 2025 to 2034. The market is growing due to factors like the rising construction and furniture industries and the need for sustainable materials. Laminating adhesives are important for the strength of engineered timber products, while the furniture industry's preference for laminated timber supports further growth.

By Resin Type Insights

Melamine formaldehyde adhesives have led the market in 2024 because they are cheaper and offer moderate bonding strength, making them suitable for less demanding uses in furniture and construction. Polyurethane adhesives are also being used more often due to their versatility and moisture resistance. Emulsion polymer isocyanate adhesives are gaining traction for their fast-curing times and low emissions, appealing to those seeking eco-friendly options.

By Application Insights

Floor beams hold a large part of the market due to the common use of laminated timber for its strength, durability, and design flexibility. Window and door headers are also important applications, as laminated timber can bear heavy loads and improve stability, especially in residential and commercial buildings. Trusses and supporting columns are other key areas where laminated timber provides a lightweight and strong support for structures.

Laminated timber is also used in transportation, marine, and industrial sectors, adding to market share. While floor beams, roof beams, and trusses are main segments, new applications are developing through innovations in timber engineering and building techniques, with a focus on sustainability likely to increase laminated timber's use in various applications.

By End-User Insights

In 2024, residential construction is anticipated to hold the biggest market share, and it is anticipated to expand considerably until 2034. This growth is driven by the increasing use of timber as a sustainable and attractive building material in homes. Commercial applications are also important, using laminated timber in offices, retail, and hospitality buildings due to its versatility and cost-effectiveness.

Regional Insights

In 2024, North America held a dominant position in the timber laminating adhesives market. Laminating adhesives are in high demand because of the U.S. construction industry's desire for engineered timber products, such as laminated lumber. Additionally, the demand for these adhesives is greatly increased by the U.S. furniture business. The market is expected to increase in the United States due to factors such as improvements in adhesive formulations, stringent regulations for environmentally friendly products, and the growing trend of sustainable construction methods. However, variations may exist in North America due to local regulations, climate, and economic conditions. Overall, the U. S. market holds a significant share, with expansion opportunities linked to infrastructure development and sustainable building awareness.

Market Competitive Landscape

The timber laminating adhesives industry is moderately fragmented, with numerous main manufacturers competing for market share. Henkel AG & Co. KGaA, H.B. Fuller Company, 3M Company, Sika AG, and Akzo Nobel N.V. are among the leading players in this market. Each of these organisations brings distinct strengths and product offerings to the table, catering to a wide range of customer demands and preferences. Furthermore, Bostik SA (Arkema Group), Dow Chemical Company, Huntsman Corporation, LORD Corporation, and Ashland Global Holdings Inc. all make substantial contributions to the market's competitive dynamics, broadening the spectrum of accessible solutions.

Recent Developments:

In December 2024, Arkema strengthened its position in North America and Europe by paying $250 million to acquire Dow's flexible packaging laminating adhesives division. With a $50 million integration investment and an anticipated $30 million in benefits over five years, the acquisition is anticipated to strengthen Arkema's position in environmentally friendly packaging adhesives.

In June 2023, Henkel AG held a groundbreaking ceremony for its new manufacturing adhesive-based business unit in Shandong Province, China. The new factory, named 'Kunpeng,' will cost approximately USD 126 million. The facility would strive to address rising demand and Henkel's consumer base by optimising the supply network in Asia Pacific and international markets.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Resin Type, By Application, By End-User |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | 3M Company, Akzo Nobel N.V, Bostik SA (Arkema Group), Dow Chemical Company, H.B. Fuller Company, Henkel AG & Co. KGaA, Sika AG.

|

Key Topics Covered in the Report

- Global Timber Laminating Adhesives Market Size (FY’2021-FY’2034)

- Overview of Global Timber Laminating Adhesives Market

- Segmentation of Global Timber Laminating Adhesives Market By Resin Type (Melamine Formaldehyde, Phenol Resorcinol Formaldehyde Adhesives, Polyurethane, Emulsion Polymer Isocyanate Adhesives)

- Segmentation of Global Timber Laminating Adhesives Market By Application (Floor beams, Roof beams, Window and door headers, Trusses and supporting columns, Others)

- Segmentation of Global Timber Laminating Adhesives Market By End User (Residential, Commercial, Industrial, Institutional, Others)

- Statistical Snap of Global Timber Laminating Adhesives Market

- Expansion Analysis of Global Timber Laminating Adhesives Market

- Problems and Obstacles in Global Timber Laminating Adhesives Market

- Competitive Landscape in the Global Timber Laminating Adhesives Market

- Details on Current Investment in Global Timber Laminating Adhesives Market

- Competitive Analysis of Global Timber Laminating Adhesives Market

- Prominent Players in the Global Timber Laminating Adhesives Market

- SWOT Analysis of Global Timber Laminating Adhesives Market

- Global Timber Laminating Adhesives Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Timber Laminating Adhesives Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Timber Laminating Adhesives Market

7. Global Timber Laminating Adhesives Market, By Resin type (USD Million) 2021-2034

7.1. Melamine formaldehyde

7.2. Phenol resorcinol formaldehyde adhesives

7.3. Polyurethane

7.4. Emulsion polymer isocyanate adhesives

7.5. Others

8. Global Timber Laminating Adhesives Market, By Application (USD Million) 2021-2034

8.1. Floor beams

8.2. Roof beams

8.3. Window and door headers

8.4. Trusses and supporting columns

8.5. Others

9. Global Timber Laminating Adhesives Market, By End-User (USD Million) 2021-2034

9.1. Residential

9.2. Commercial

9.3. Industrial

9.4. Institutional

9.5. Others

10. Global Timber Laminating Adhesives Market, (USD Million) 2021-2034

10.1. Global Timber Laminating Adhesives Market Size and Market Share

11. Global Timber Laminating Adhesives Market, By Region, (USD Million) 2021-2034

1.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. 3M Company

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Akzo Nobel N.V

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Bostik SA (Arkema Group)

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Dow Chemical Company

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. H.B. Fuller Company

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Henkel AG & Co. KGaA

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Sika AG

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.