Titanium Nitride Coating Market Introduction and Overview

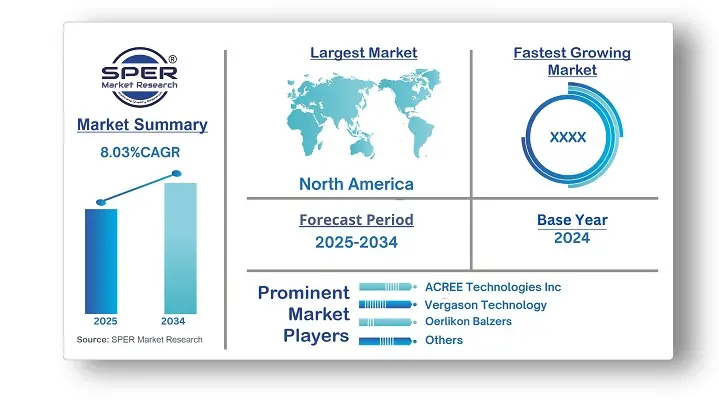

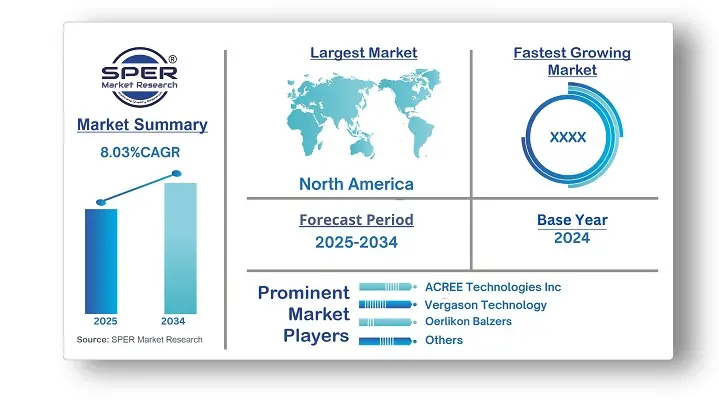

According to SPER Market Research, the Global Titanium Nitride Coating Market is estimated to reach USD 3.11 billion by 2034 with a CAGR of 8.03%

The report includes an in-depth analysis of the Global Titanium Nitride Coating Market, including market size and trends, product mix, Applications, and supplier analysis. Several factors are contributing to the global growth of the titanium nitride coating market. A key driver is the rising demand for wear-resistant coatings across various sectors, including automotive, aerospace, and cutting tools. Titanium nitride coatings are highly valued for their exceptional hardness, wear resistance, and corrosion protection, which significantly enhance the durability and performance of components. Additionally, ongoing advancements in coating technologies and the expanding range of applications in emerging industries are further accelerating market expansion. The continuous need to improve the longevity and efficiency of industrial components remains a major factor fueling the demand for titanium nitride coatings. However, Volatile prices of raw materials like titanium and nitrogen challenge the titanium nitride coating industry, impacting production costs and profit margins. Managing these fluctuations is essential for maintaining competitiveness and financial stability.

By Coating Process:

The market, based on coating process, is divided into physical vapor deposition (PVD) and chemical vapor deposition (CVD), with PVD standing out as the leading segment. A notable trend within the PVD process for titanium nitride coatings is the continuous progress in coating technology. Manufacturers are prioritizing improvements in deposition techniques, equipment performance, and coating quality to boost durability and functionality. There's also a rising emphasis on developing eco-friendly PVD processes, with sustainable, low-impact coating solutions gaining traction across industries like automotive, aerospace, and electronics.

By Application:

The titanium nitride coating market, based on application, includes segments such as cutting tools, decorative coatings, molds & dies, tooling & industrial equipment, cutlery & kitchenware, and others, with cutting tools being a key area of use. Titanium nitride coatings are essential in enhancing the performance and durability of cutting tools. Applied mainly through physical vapor deposition (PVD), these coatings significantly boost hardness, wear resistance, and thermal stability. This results in longer tool life, reduced friction, and higher cutting speeds, making them well-suited for demanding machining tasks across industries like automotive, aerospace, manufacturing, and metalworking.

By End User:

The titanium nitride coating market, based on end-use, is segmented into automotive, aerospace, chemical, consumer goods, and others, with the automotive sector representing a significant share. This segment is experiencing steady growth, driven by the increasing use of titanium nitride coatings to enhance the durability and performance of automotive components.

By Regional Insights

The Asia Pacific region held a leading position in the global titanium nitride coating market and is projected to continue experiencing strong growth. This expansion is largely driven by rapid industrialization and infrastructure development across the region. Growing demand from key sectors such as automotive, aerospace, and electronics is fueling the need for durable, wear-resistant coatings. Additionally, advancements in coating technologies and increased investment in research and development are spurring innovation. Rising awareness of the advantages of titanium nitride coatings is also contributing to their broader adoption across various industries in the region.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are ACREE Technologies Inc., Beamalloy Technologies, BryCoat Inc., Calico Coatings, NISSIN ELECTRIC Co., Ltd., Oerlikon Balzers, Surface Engineering Technologies LLC, SurfTech, Vergason Technology, Inc., voestalpine eifeler group, Wallwork Heat Treatment Ltd, and others.

Recent Developments:

In June 2021, Acree Technologies Incorporated introduced titanium nitride (TiN) targets for physical vapor deposition processes, enhancing its ability to deliver nitride-based coating solutions.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Coating Process, By Application, By End Use- |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | ACREE Technologies Inc., Beamalloy Technologies, BryCoat Inc., Calico Coatings, NISSIN ELECTRIC Co., Ltd., Oerlikon Balzers, Surface Engineering Technologies LLC, SurfTech, Vergason Technology, Inc., voestalpine eifeler group, Wallwork Heat Treatment Ltd, and others.. |

Key Topics Covered in the Report

- Global Titanium Nitride Coating Market Size (FY’2021-FY’2034)

- Overview of Global Titanium Nitride Coating Market

- Segmentation of Global Titanium Nitride Coating Market By Coating Process {(Physical Vapor Deposition (PVD), Chemical Vapor Deposition (CVD)}

- Segmentation of Global Titanium Nitride Coating Market By Application (Cutting Tools, Decorative Coatings, Mold & Dies, Tooling & Industrial Equipment, Cutlery and Kitchenware, Others)

- Segmentation of Global Titanium Nitride Coating Market By End-use (Automotive, Aerospace, Chemical, Consumer Goods, Others)

- Statistical Snap of Global Titanium Nitride Coating Market

- Expansion Analysis of Global Titanium Nitride Coating Market

- Problems and Obstacles in Global Titanium Nitride Coating Market

- Competitive Landscape in the Global Titanium Nitride Coating Market

- Details on Current Investment in Global Titanium Nitride Coating Market

- Competitive Analysis of Global Titanium Nitride Coating Market

- Prominent Players in the Global Titanium Nitride Coating Market

- SWOT Analysis of Global Titanium Nitride Coating Market

- Global Titanium Nitride Coating Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Titanium Nitride Coating Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Titanium Nitride Coating Market

7. Global Titanium Nitride Coating Market, By Coating Process, (USD Million) 2021-2034

7.1. Physical Vapor Deposition (PVD)

7.2. Chemical Vapor Deposition (CVD)

8. Global Titanium Nitride Coating Market, By Application, (USD Million) 2021-2034

8.1. Cutting Tools

8.2. Decorative Coatings

8.3. Mold & Dies

8.4. Tooling & Industrial Equipment

8.5. Cutlery and Kitchenware

8.6. Others

9. Global Titanium Nitride Coating Market, By End-use, (USD Million) 2021-2034

9.1. Automotive

9.2. Aerospace

9.3. Chemical

9.4. Consumer Goods

9.5. Others

10. Global Titanium Nitride Coating Market, (USD Million) 2021-2034

10.1. Global Titanium Nitride Coating Market Size and Market Share

11. Global Titanium Nitride Coating Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. ACREE TECHNOLOGIES INC.

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Beamalloy Technologies

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. BryCoat Inc.

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Calico Coatings

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. NISSIN ELECTRIC Co., Ltd.

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. NISSIN ELECTRIC Co., Ltd.

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Oerlikon Balzers

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Surface Engineering Technologies LLC

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. SurfTech.

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Vergason Technology, Inc

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. voestalpine eifeler group

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Wallwork Heat Treatment Ltd

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links