Vanillic Acid Market Introduction and Overview

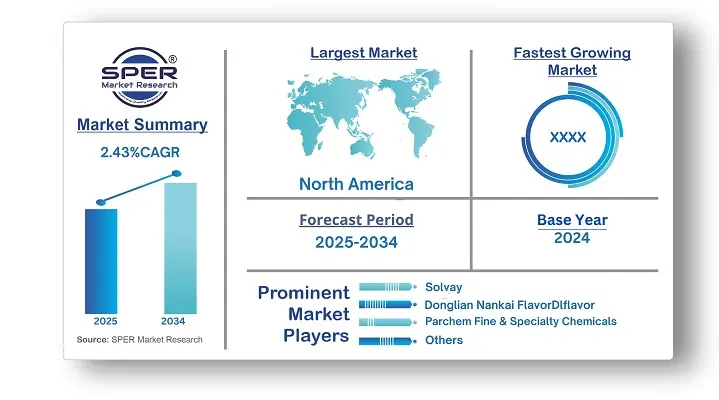

According to SPER Market Research, the Global Vanillic Acid Market is estimated to reach USD 26.81 billion by 2034 with a CAGR of 2.43%.

The report includes an in-depth analysis of the Global Vanillic Acid Market, including market size and trends, product mix, Applications, and supplier analysis. The global vanillic acid market was valued at USD 21.09 billion in 2024, and it is predicted to increase at a compound annual growth rate (CAGR) of 2.43% between 2025 and 2034. Rising demand for natural and organic goods in the food and cosmetic industries is one of the primary factors driving market expansion across regions. The substance can be used as a flavouring agent, perfume base, or medicinal intermediate. Vanillic acid is a naturally occurring component derived from plants, making it an ideal choice for firms seeking to produce natural and organic products.

By Application Insights

The flavors and fragrances segment had the largest revenue share in 2024, driven by increasing awareness of eco-friendly and natural products like perfumes, deodorants, and air purifiers. These fragrances are essential in creating products such as candles, essential oils, and organic perfumes. Rising consumer interest in aromatherapy, toiletries, and car fresheners is expected to further increase demand.

In cosmetics and personal care, vanillic acid serves as an antioxidant and skin conditioner. The shift towards natural and organic cosmetics is likely to boost market growth. Additionally, the food and beverage industry is changing due to higher disposable income and busy lifestyles, increasing the use of vanillin in ready-to-eat and processed foods.

By Purity Insights

In 2024, the 98% purity segment held the greatest market share. This is due to increased demand in the food and beverage and personal care industries. It is used as an intermediate in the purification of vanillin from ferulic acid. It is a popular flavouring agent in the food sector. It is also utilised in anti-aging skincare treatments. The demand for skin treatments continues to rise due to a variety of variables, including changing lifestyles, increasing age, diet, and environmental factors such as sunlight and pollution.

Regional Insights

Asia Pacific led the global vanillic acid market in 2024 due to increased demand from countries like China, India, and Japan. These nations have seen significant growth in their food and beverage industries, boosting the need for vanillic acid. Additionally, urbanization and economic growth are driving construction needs for quality materials. The trend for natural and clean-label products is rising in this region due to health, wellness, and sustainability concerns, leading consumers to favor ingredients from vanilla beans.

Market Competitive Landscape

Major companies in the Vanillic Acid Market sector are continuously looking for ways to acquire a competitive advantage, such as investing in R&D, expanding product portfolios, and developing strategic partnerships. Leading Vanillic Acid Market players are focussing on providing unique goods that meet the changing needs of consumers. The rising demand for natural and organic components in food and beverage items is driving the growth of the vanillic acid market. The increased knowledge of vanillic acid's health advantages is also helping to drive market expansion.

Recent Developments:

Solvay has introduced new natural vanillin flavours specifically for the food and beverage industries. This expansion broadens the range of Rhovanil Natural CW, one of its flagship products, by including three new natural flavour components: Rhovanil Natural Delica, Alta, and Sublime.

Tokyo Chemical Industry announced in March 2024 that it will enhance its production capacities. The strategic move aims to increase supply capacity to meet rising global demand for vanillic acid, particularly in the pharmaceutical and food sectors.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Application, By Purity |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Solvay, Donglian Nankai FlavorDlflavor, Quzhou Mingfeng Chemical, The Good Scents Company, Parchem Fine & Specialty Chemicals, Otto Chemie Pvt. Ltd, Lanxess. |

Key Topics Covered in the Report

- Global Vanillic Acid Market Size (FY’2021-FY’2034)

- Overview of Global Vanillic Acid Market

- Segmentation of Global Vanillic Acid Market By Application (Pharmaceutical Intermediates, Flavors and Fragrances, Other Applications)

- Segmentation of Global Vanillic Acid Market By Purity (Purity 99%, Purity 98%, Others)

- Statistical Snap of Vanillic Acid Market

- Expansion Analysis of Global Vanillic Acid Market

- Problems and Obstacles in Global Vanillic Acid Market

- Competitive Landscape in the Global Vanillic Acid Market

- Details on Current Investment in Global Vanillic Acid Market

- Competitive Analysis of Global Vanillic Acid Market

- Prominent Players in the Global Vanillic Acid Market

- SWOT Analysis of Global Vanillic Acid Market

- Global Vanillic Acid Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Vanillic Acid Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Vanillic Acid Market

7. Global Vanillic Acid Market, By Application (USD Million) 2021-2034

7.1. Pharmaceutical Intermediates

7.2. Flavors and Fragrances

7.3. Other Applications

8. Global Vanillic Acid Market, By Purity (USD Million) 2021-2034

8.1. Purity 99%

8.2. Purity 98%

8.3. Others

9. Global Vanillic Acid Market, (USD Million) 2021-2034

9.1. Global Vanillic Acid Market Size and Market Share

10. Global Vanillic Acid Market, By Region, (USD Million) 2021-2034

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. Solvay

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. Donglian Nankai FlavorDlflavor

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Quzhou Mingfeng Chemical

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. The Good Scents Company

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. Parchem Fine & Specialty Chemicals

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Otto Chemie Pvt. Ltd

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Lanxess

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.