Zero Friction Coating Market and Overview

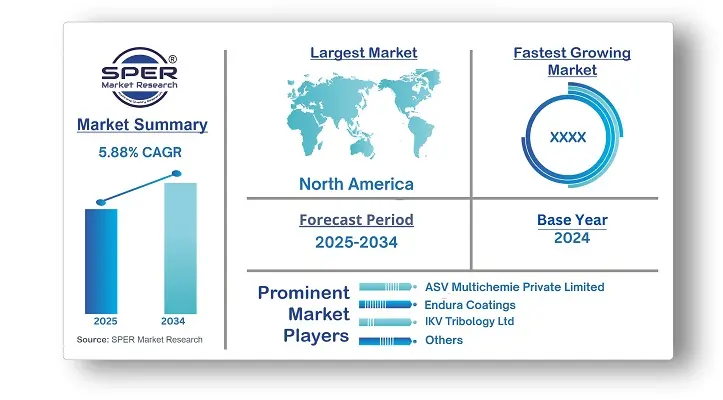

According to SPER Market Research, the Global Zero Friction Coating Market is estimated to reach USD 1839.91 million by 2034 with a CAGR of 5.88%.

The report includes an in-depth analysis of the Global Zero Friction Coating Market, including market size and trends, product mix, Applications, and supplier analysis. The increasing demand for zero friction coatings is driven by their ability to provide both lubrication and corrosion protection, thereby extending the lifespan of components used in industries like automotive, energy, and aerospace. These coatings allow surfaces to interact with minimal wear, reducing component degradation. Essential features like resistance to vacuum and radiation, clean and dry lubrication that remains effective even in dusty environments, non-flammability, and strong oxidation resistance are anticipated to further drive market growth in the coming years. However, challenges such as high friction under low loads and an elevated coefficient of friction in humid conditions may hinder market expansion.

By Type:

The molybdenum disulfide (MoS₂) segment emerged as the dominant type, owing to its excellent load-bearing capacity and strong adhesion properties. As a dry film lubricant, MoS₂ effectively prevents galling, fretting, and seizing, while performing reliably in a wide temperature range from -350°F to +500°F. It also offers a low coefficient of friction (0.07) and resists reaction with most corrosive agents, making it suitable for critical parts. The polytetrafluoroethylene (PTFE) segment ranked second and is expected to grow steadily in the coming years.

By Formulation:

The solvent-based segment led the market in 2021, primarily due to its reduced sensitivity to environmental factors such as humidity and temperature during the curing process. The water-based coating segment followed closely, showing strong growth potential driven by its low volatile organic compound (VOC) content, durability under accelerated aging conditions, and its ability to incorporate pigments. Additionally, water-based coatings offer lower friction and improved resistance to weathering, further contributing to their increasing adoption.

By Formulation:

The automobile and transportation segment held the leading position in the market. This dominance is largely due to the ability of zero friction coatings to reduce noise, making them well-suited for automotive applications—particularly in minimizing cabin noise, which has become a key focus in modern vehicles. The expanding global automotive market, along with the increasing adoption of electric vehicles, is expected to further support the growth of the industry, thereby positively influencing the demand for zero friction coatings.

By Regional Insights

Asia Pacific emerged as the leading region in the zero friction coatings market, largely due to the strong presence of automotive manufacturing hubs in countries like Japan, South Korea, and China. The region benefits from being home to several major automotive brands, including Honda, Toyota, Ford, and BMW. Additionally, Southeast Asia is recognized as a significant player in global vehicle production, further boosting regional demand. The continuous expansion of the automobile industry in Asia Pacific is expected to drive the adoption of zero friction coatings in the coming years. Europe also played a notable role in the market and is projected to experience steady growth, supported by an increase in vehicle production despite challenges related to supply chain disruptions.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are, GMM Coatings Private Limited, IKV Tribology Ltd., Poeton, VITRACOAT, ASV Multichemie Private Limited, Bechem, DuPont, Endura Coatings.

Recent Developments:

In 2022, PPG announced the completion of its acquisition of the powder coatings manufacturing division of Arsonsisi, an industrial coatings firm headquartered in Milan, Italy. This acquisition adds a highly automated powder manufacturing facility in Verbania, Italy, to PPG’s portfolio, capable of handling both small and large batch production.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Formulation, By End Use |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | ASV Multichemie Private Limited, Bechem, DuPont, Endura Coatings, GMM Coatings Private Limited, IKV Tribology Ltd., Poeton, VITRACOAT.

|

Key Topics Covered in the Report

Global Zero Friction Coating Market Size (FY’2021-FY’2034)

Overview of Global Zero Friction Coating Market

Segmentation of Global Zero Friction Coating Market By Type (Polytetrafluoroethylene, Molybdenum Disulfide, Others)

Segmentation of Global Zero Friction Coating Market By Formulation (Solvent-based Coatings, Water-based Coatings, Powder Coatings)

Segmentation of Global Zero Friction Coating Market By End-use (Automobile & Transportation, Aerospace, General Engineering, Food & Healthcare, Energy, Others)

Statistical Snap of Global Zero Friction Coating Market

Expansion Analysis of Global Zero Friction Coating Market

Problems and Obstacles in Global Zero Friction Coating Market

Competitive Landscape in the Global Zero Friction Coating Market

Details on Current Investment in Global Zero Friction Coating Market

Competitive Analysis of Global Zero Friction Coating Market

Prominent Players in the Global Zero Friction Coating Market

SWOT Analysis of Global Zero Friction Coating Market

Global Zero Friction Coating Market Future Outlook and Projections (FY’2025-FY’2034)

Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Zero Friction Coating Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Zero Friction Coating Market

7. Global Zero Friction Coating Market, By Type, (USD Million) 2021-2034

7.1. Polytetrafluoroethylene

7.2. Molybdenum Disulfide

7.3. Others

8. Global Zero Friction Coating Market, By Formulation, (USD Million) 2021-2034

8.1. Solvent-based Coatings

8.2. Water-based Coatings

8.3. Powder Coatings

9. Global Zero Friction Coating Market, By End-use, (USD Million) 2021-2034

9.1. Automobile & Transportation

9.2. Aerospace

9.3. General Engineering

9.4. Food & Healthcare

9.5. Energy

9.6. Others

10. Global Zero Friction Coating Market, (USD Million) 2021-2034

10.1. Global Zero Friction Coating Market Size and Market Share

11. Global Zero Friction Coating Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. ASV Multichemie Private Limited

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Bechem

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. DuPont

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Endura Coatings

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. GMM Coatings Private Limited

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. IKV Tribology Ltd.

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Poeton

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. VITRACOAT

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.