Europe Traction Battery Market Introduction and Overview

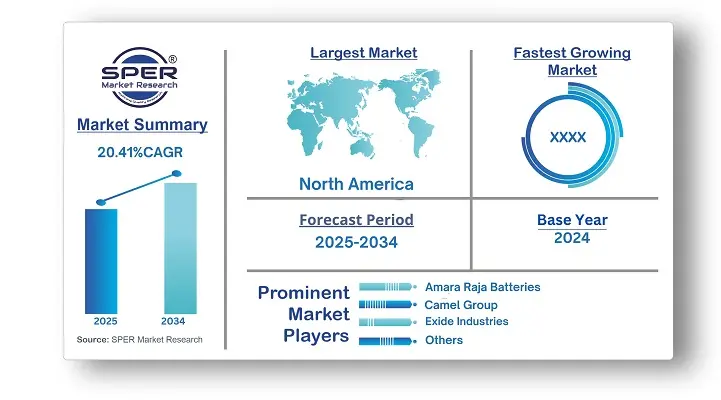

According to SPER Market Research, the Europe Traction Battery Market is estimated to reach USD 138.45 billion by 2034 with a CAGR of 20.41%.

The report includes an in-depth analysis of the Europe Traction Battery Market, including market size and trends, product mix, Applications, and supplier analysis. The European market for traction batteries is anticipated to increase at a compound annual growth rate (CAGR) of 20.41% between 2025 and 2034, reaching an estimated USD 21.61 billion in 2024. Europe's dominance in battery technology is being strengthened by partnerships between automotive and battery makers. The European Battery Alliance (EBA) seeks to create a sustainable and competitive value chain for the production of battery cells in Europe, guaranteeing technological independence and industry expansion.

By Chemistry Insights

The industry is divided into several categories, including nickel-based, lithium-ion, and lead acid. Since lithium-ion has a better weight-to-energy ratio—which is crucial for EVs and industrial applications—it is anticipated to dominate the market in 2024. Support from EU Green Deal policies, subsidies, and research funding promotes local development. Lead-acid batteries are much cheaper and preferred for budget-friendly needs like forklifts and low-speed electric transport, with a high recycling rate of about 99%.

By Application Insights

The three segments of the European traction battery market are e-bikes, industrial, and electric cars. The electric vehicles segment is expected to dominate in 2024 and continue to grow positively through 2034, driven by strict emissions regulations and incentives from European governments. Additionally, there is a trend towards electrifying industrial equipment to enhance efficiency and reduce emissions, as well as the adoption of energy storage solutions in industrial facilities.

Regional Insights

The industrial traction battery market in Europe is dominated by Germany, and this trend is expected to continue. Advanced battery technologies are in high demand in Germany's strong and dominant automotive business, which places a significant focus on innovation and sustainability. The German government is a prominent advocate for electric mobility and makes large investments in the R&D and manufacturing capacities of batteries and electric vehicles.

Market Competitive Landscape

The market leaders for traction batteries are concentrating on a number of tactics to keep their competitive edge. These include strategic alliances and collaborations to broaden market reach and improve product offerings, investments in research and market developments to improve battery performance and lower costs, and expansion initiatives to meet the rising demand for traction batteries in electric vehicles and other applications. In order to meet changing consumer demands and market trends, businesses are also developing new battery chemistries and technologies.

Recent Developments:

Scania, a truck division of Volkswagen, successfully acquired Northvolt Solutions Industrial in April 2025. Northvolt Solutions Industrial specialised in battery solutions for heavy sectors, including mining and construction. This acquisition includes a production site in Poland and an R&D centre in Sweden, which will expand Scania's electrification solutions for off-road applications.

In December 2024, CATL and Stellantis formed a joint venture with a valuation of approximately USD 4.68 billion to construct an electric vehicle battery production facility in Zaragoza, Spain. The project, which will be operational by late 2026, will use renewable energy to make lithium iron phosphate batteries, in line with both firms' sustainability aims.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Chemistry, By Application |

| Regions covered | France, Germany, Italy, Spain, United Kingdom, Rest of Europe |

| Companies Covered | Amara Raja Batteries, Camel Group, Ecovolta, Enersys, Exide Industries, Hitachi Energy, Hoppecke Batteries, LG Energy Solution, Midac, Mutlu, Panasonic, Samsung SDI, Toshiba.

|

Key Topics Covered in the Report

- Europe Traction Battery Market Size (FY’2021-FY’2034)

- Overview of Europe Traction Battery Market

- Segmentation of Europe Traction Battery Market By Chemistry (Lead Acid, Lithium-Ion, Nickel Based, Others)

- Segmentation of Europe Traction Battery Market By Application (Electric Vehicles, Industrial, E-Bike)

- Statistical Snap of Europe Traction Battery Market

- Expansion Analysis of Europe Traction Battery Market

- Problems and Obstacles in Europe Traction Battery Market

- Competitive Landscape in the Europe Traction Battery Market

- Details on Current Investment in Europe Traction Battery Market

- Competitive Analysis of Europe Traction Battery Market

- Prominent Players in the Europe Traction Battery Market

- SWOT Analysis of Europe Traction Battery Market

- Europe Traction Battery Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Europe Traction Battery Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Europe Traction Battery Market

7. Europe Traction Battery Market, By Chemistry (USD Million) 2021-2034

7.1. Lead Acid

7.2. Lithium-Ion

7.3. Nickel Based

7.4. Others

8. Europe Traction Battery Market, By Application (USD Million) 2021-2034

8.1. Electric Vehicles

8.1.1. BEV

8.1.2. PHEV

8.2. Industrial

8.2.1. Forklifts

8.2.2. Railroads

8.2.3. Others

8.3. E-Bike

8.3.1. E-scooters

8.3.2. E-motorcycles

9. Europe Traction Battery Market, (USD Million) 2021-2034

9.1. Europe Traction Battery Market Size and Market Share

10. Europe Traction Battery Market, By Region, (USD Million) 2021-2034

10.1. France

10.2. Germany

10.3. Italy

10.4. Spain

10.5. United Kingdom

10.6. Rest of Europe

11. Company Profile

11.1. Amara Raja Batteries

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. Camel Group

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Ecovolta

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Enersys

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. Exide Industries

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Hitachi Energy

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Hoppecke Batteries

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. LG Energy Solution

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Midac

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. Mutlu

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. Panasonic

11.11.1. Company details

11.11.2. Financial outlook

11.11.3. Product summary

11.11.4. Recent developments

11.12. Samsung SDI

11.12.1. Company details

11.12.2. Financial outlook

11.12.3. Product summary

11.12.4. Recent developments

11.13. Toshiba

11.13.1. Company details

11.13.2. Financial outlook

11.13.3. Product summary

11.13.4. Recent developments

11.14. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.