Saudi Arabia ATM Managed Service Market Overview

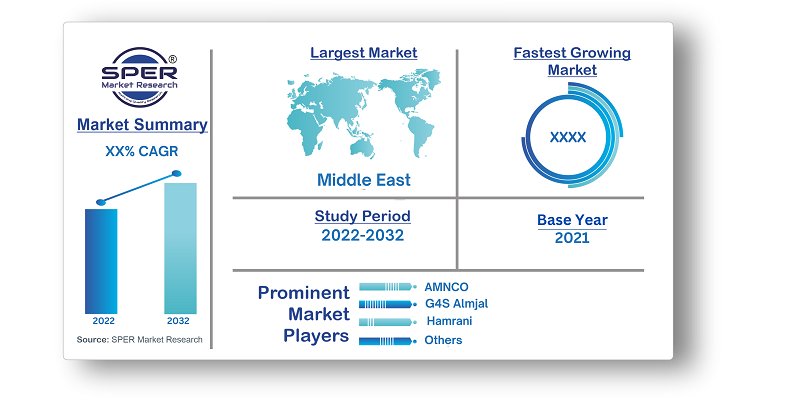

According to SPER Market Research, the Saudi Arabia ATM Managed Service Market is estimated to reach USD XX billion by 2032 with a CAGR of XX%.

ATM (automated teller machine) managed services refer to the outsourcing of ATM operations, including maintenance, security, and monitoring, to third-party service providers. The ATM managed service market in Saudi Arabia is driven by factors such as the growing adoption of digital banking solutions, the need for cost-effective ATM operations, and the increasing focus on improving the customer experience. In recent years, the ATM managed service market in Saudi Arabia has experienced significant growth, with a growing number of banks and financial institutions outsourcing their ATM operations to specialized service providers. The market is characterized by a mix of large multinational corporations and regional players, with the presence of global players such as Diebold Nixdorf, NCR Corporation, and GRG Banking. The Saudi Arabia ATM managed service market is expected to continue to grow in the coming years, driven by increasing demand and favourable government initiatives aimed at promoting digital banking solutions.

Impact of COVID-19 on the Saudi Arabia ATM Managed Service Market

The COVID-19 pandemic has had a significant impact on the Saudi Arabia ATM managed service market. The lockdowns and travel restrictions implemented by the Saudi government to contain the spread of the virus have affected the demand for ATM services, leading to a decline in revenue for ATM managed service providers.One of the major impacts of the pandemic has been a significant decline in cash withdrawals as people moved towards cashless payments to avoid physical contact with ATMs. With the decrease in cash withdrawals, the revenue of ATM operators and managed service providers has been adversely affected. The lockdowns have also affected the movement of service personnel, causing delays in ATM maintenance and repair services.

The pandemic has also brought about changes in consumer behaviour, with more people opting for online banking and digital payment options. This trend has accelerated the shift towards digital payment solutions and reduced the need for physical ATM services. This has resulted in a decline in the demand for ATM managed services, with several banks re-evaluating their ATM network and reducing the number of ATMs in operation.

However, the pandemic has also presented opportunities for ATM managed service providers to introduce innovative solutions, such as touchless ATMs, to meet the evolving needs of consumers. Additionally, the Saudi government's initiatives to promote cashless transactions and digital payments have created new growth opportunities for ATM managed service providers.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Saudi Arabia ATM managed service market, with a decline in revenue due to reduced cash withdrawals and maintenance services, but also an opportunity to introduce innovative solutions and expand the digital payment ecosystem. The long-term impact on the market will depend on how effectively managed service providers adapt to the changing needs of consumers and capitalize on the government's initiatives to promote cashless transactions.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2019-2032 |

| Base year considered | 2021 |

| Forecast period | 2022-2032 |

| Segments covered | By Type of ATMs, By Service Offerings

|

| Regions covered | The Emirate of the Riyadh Province, The Emirate of the Makkah Province, The Emirate of the Eastern Province, The Emirate of the Madinah Province, The Emirate of the Al Baha Province, The Emirate of the Al Jawf Province, The Emirate of the Northern Borders Province, The Emirate of the Qassim Province, The Emirate of the Ha’il Province, The Emirate of the Tabuk Province, The Emirate of the Aseer Province, The Emirate of the Jizan Province, The Emirate of the Najran Province

|

| Companies Covered | Abana, Abu-Sarhad, AMNCO, G4S Almjal, Hamrani, Hemaia Group, Hyosung, NCR, Sanid

|

Target Audience:

- Managed Service Providers

- Major ATM Suppliers / Vendors

- Cash Management Companies

- Banks (Private, Commercial, State)

- Saudi Arabian Monetary Authority (SAMA)

- Government Institutions

- Investors

- Facility Management Companies

Saudi Arabia ATM Managed Service Market Segmentation:

1. By Type of ATMs:

- On-Site ATMs

- Off-Site ATMs

- Mobile ATMs

2. By Service offerings:

- Cash Management Service

- ATM Site Maintenance

- ATM Repair & Maintenance & Other Services

3. By Region:

- The Emirate of the Riyadh Province

- The Emirate of the Makkah Province

- The Emirate of the Eastern Province

- The Emirate of the Madinah Province

- The Emirate of the Al Baha Province

- The Emirate of the Al Jawf Province

- The Emirate of the Northern Borders Province

- The Emirate of the Qassim Province

- The Emirate of the Ha’il Province

- The Emirate of the Tabuk Province

- The Emirate of the Aseer Province

- The Emirate of the Jizan Province

- The Emirate of the Najran Province

Key Topics Covered in the Report:

- Size of Saudi Arabia ATM Managed Service Market (FY’2019-FY’2032)

- Overview of Saudi Arabia ATM Managed Service Market

- Segmentation of Saudi Arabia ATM Managed Service Market By Type of ATMs (On-Site ATMs, Off-Site ATMs, Mobile ATMs)

- Segmentation of Saudi Arabia ATM Managed Service Market By Service Offerings (Cash Management Service, ATM Site Maintenance, ATM Repair & Maintenance & Other Services)

- Statistical Snap of Saudi Arabia ATM Managed Service Market

- Growth Analysis of Saudi Arabia ATM Managed Service Market

- Problems and Challenges in Saudi Arabia ATM Managed Service Market

- Competitive Landscape in the Saudi Arabia ATM Managed Service Market

- Impact of COVID-19 and Demonetization on Saudi Arabia ATM Managed Service Market

- Details on Recent Investment in Saudi Arabia ATM Managed Service Market

- Competitive Analysis of Saudi Arabia ATM Managed Service Market

- Major Players in the Saudi Arabia ATM Managed Service Market

- SWOT Analysis of Saudi Arabia ATM Managed Service Market

- Saudi Arabia ATM Managed Service Market Future Outlook and Projections (FY’2019-FY’2032)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1 Research data source

2.1.1 Secondary data

2.1.2 Primary data

2.1.3 SPER’s internal database

2.1.4 Premium insight from KOL’s

2.2 Market size estimation

2.2.1 Top-down and Bottom-up approach

2.3 Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2. COVID-19 Impacts of the Saudi Arabia ATM Managed Service Market

5. Market variables and outlook

5.1. SWOT analysis

5.1.1 Strengths

5.1.2 Weaknesses

5.1.3 Opportunities

5.1.4 Threats

5.2. PESTEL analysis

5.2.1 Political landscape

5.2.2 Economic landscape

5.2.3 Social landscape

5.2.4 Technological landscape

5.2.5 Environmental landscape

5.2.6 Legal landscape

5.3. PORTER’S five forces analysis

5.3.1 Bargaining power of suppliers

5.3.2 Bargaining power of Buyers

5.3.3 Threat of Substitute

5.3.4 Threat of new entrant

5.3.5 Competitive rivalry

5.4. Heat map analysis

6. Competitive Landscape

6.1 Saudi Arabia ATM Managed Service Market Manufacturing Base Distribution, Sales Area, Product Type

6.2 Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Saudi Arabia ATM Managed Service Market

7. Saudi Arabia ATM Managed Service Market, By Type of ATMs, 2019-2032 (USD Million)

7.1 On-Site ATMs

7.2 Off-Site ATMs

7.3 Mobile ATMs

8. Saudi Arabia ATM Managed Service Market, By Service offerings, 2019-2032(USD Million)

8.1 Cash Management Service

8.2 ATM Site Maintenance

8.3 ATM Repair & Maintenance & Other Services

9. Saudi Arabia ATM Managed Service Market, By Region, 2019-2032 (USD Million)

9.1 Saudi Arabia ATM Managed Service Market Size and Market Share by Region (2019-2025)

9.2 Saudi Arabia ATM Managed Service Market Size and Market Share by Region (2026-2032)

9.3 The Emirate of the Riyadh Province

9.4 The Emirate of the Makkah Province

9.5 The Emirate of the Eastern Province

9.6 The Emirate of the Madinah Province

9.7 The Emirate of the Al Baha Province

9.8 The Emirate of the Al Jawf Province

9.9 The Emirate of the Northern Borders Province

9.10 The Emirate of the Qassim Province

9.11 The Emirate of the Ha’il Province

9.12 The Emirate of the Tabuk Province

9.13 The Emirate of the Aseer Province

9.14 The Emirate of the Jizan Province

9.15 The Emirate of the Najran Province

10. Company Profiles

10.1 Abana

10.1.1 Company details

10.1.2 Financial outlook

10.1.3 Product summary

10.1.4 Recent developments

10.2 Abu-Sarhad

10.2.1 Company details

10.2.2 Financial outlook

10.2.3 Product summary

10.2.4 Recent developments

10.3 AMNCO

10.3.1 Company details

10.3.2 Financial outlook

10.3.3 Product summary

10.3.4 Recent developments

10.4 G4S Almjal

10.4.1 Company details

10.4.2 Financial outlook

10.4.3 Product summary

10.4.4 Recent developments

10.5 Hamrani

10.5.1 Company details

10.5.2 Financial outlook

10.5.3 Product summary

10.5.4 Recent developments

10.6 Hemaia Group

10.6.1 Company details

10.6.2 Financial outlook

10.6.3 Product summary

10.6.4 Recent developments

10.7 Hyosung

10.7.1 Company details

10.7.2 Financial outlook

10.7.3 Product summary

10.7.4 Recent developments

10.8 NCR

10.8.1 Company details

10.8.2 Financial outlook

10.8.3 Product summary

10.8.4 Recent developments

10.9 Sanid

10.9.1 Company details

10.9.2 Financial outlook

10.9.3 Product summary

10.9.4 Recent developments

11. List of Abbreviations

12. Reference Links

13. Conclusion

14. Research Scope

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.